Introduction to Asset Tokenization

Fundamentals guide: This article introduces tokenization basics. For comprehensive investment guidance, see How to Invest in Tokenized Assets: Complete 2025 Guide.

Asset tokenization is transforming how we invest in and trade real-world assets. By converting physical and traditional financial assets into digital tokens on a blockchain, we unlock new possibilities for fractional ownership, increased liquidity, and global accessibility.

For comprehensive understanding, explore our Ultimate Guide to Tokenization and RWA, which covers all aspects of tokenization in depth. Also see What are RWAs? Real World Assets Crypto Explained for a beginner-friendly overview, and How to Invest in Tokenized Real World Assets when you're ready to start investing.

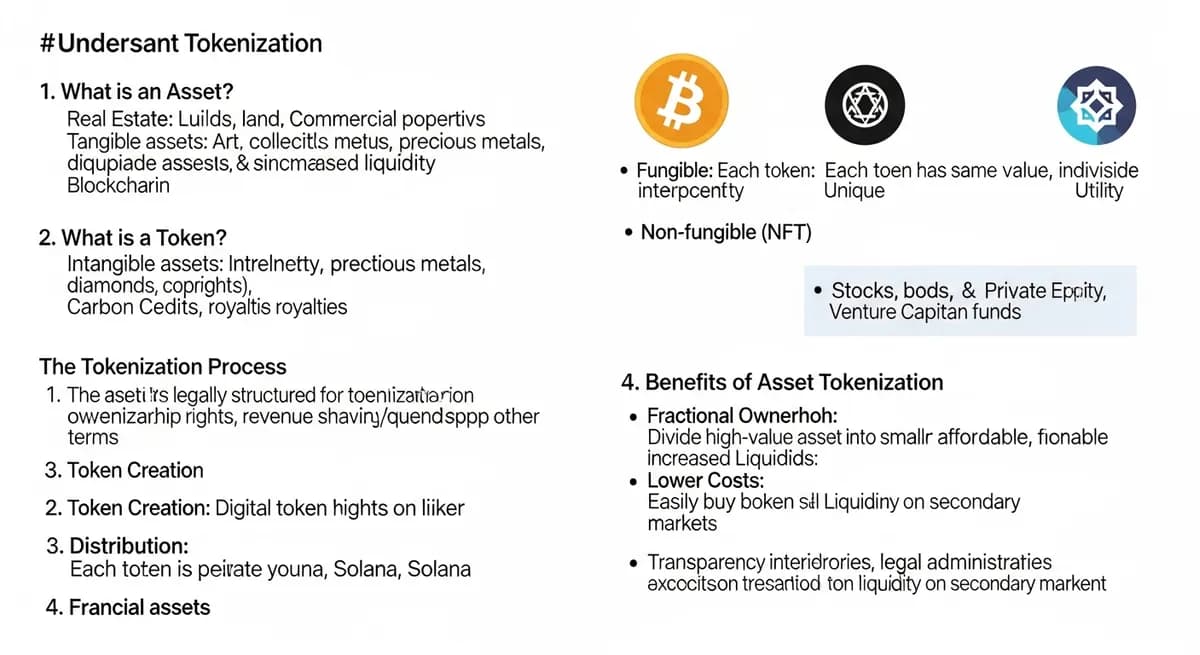

What is Asset Tokenization?#

Asset tokenization is the process of converting rights to an asset into a digital token on a blockchain. These tokens represent ownership or economic rights to the underlying asset, whether it's real estate, art, private equity, or any other valuable asset.

Key Benefits#

- Fractional Ownership: Break down high-value assets into smaller units, making them accessible to more investors

- Increased Liquidity: Transform traditionally illiquid assets into tradeable digital tokens

- Global Access: Enable worldwide investors to participate in previously local markets

- Transparency: Leverage blockchain's immutable records for transparent ownership tracking

- Reduced Costs: Automate processes through smart contracts, reducing intermediary costs

How It Works#

The tokenization process typically involves several steps:

- Asset Selection: Choose an asset suitable for tokenization

- Legal Structure: Establish the legal framework linking tokens to asset rights

- Valuation: Conduct professional valuation of the underlying asset

- Token Creation: Deploy smart contracts to create digital tokens

- Compliance: Implement KYC/AML and regulatory requirements

- Distribution: Issue tokens to investors

- Trading: Enable secondary market trading on compliant platforms

Real-World Applications#

Asset tokenization is already being applied to:

- Real Estate: Enabling fractional ownership of commercial and residential properties

- Private Equity: Democratizing access to startup investments and employee equity

- Logistics: Fleet vehicles, warehouses, and equipment tokenization

- Financial Assets: Private credit, invoice financing, and investment funds

- Supply Chain: Trade finance and shipping assets

- Consumer Brands: FMCG inventory and IP rights

The Future#

As regulatory frameworks mature and technology improves, asset tokenization will become increasingly mainstream. We're moving toward a future where any asset can be tokenized, traded globally, and owned fractionally.

Getting Started#

Interested in tokenizing your assets or investing in tokenized opportunities? Start by:

- Researching regulatory requirements in your jurisdiction

- Understanding the technical aspects of blockchain and smart contracts

- Partnering with experienced tokenization platforms like Pedex

- Conducting thorough due diligence on all investments

Asset tokenization represents a fundamental shift in how we think about ownership and investment. The technology is here, and the future is tokenized.

Deep Dive Guides by Asset Class#

Real Estate:

- Commercial Real Estate Tokenization: 2025 Guide

- Residential Property Fractionalization

- REITs vs Tokenized Real Estate Comparison

Logistics & Supply Chain:

- Tokenizing Logistics Assets

- Supply Chain Finance Through Tokenization

- Container Shipping Tokenization

Learn More: Investing in Tokenized Assets#

Comprehensive Investment Guide:

→ How to Invest in Tokenized Assets: Complete 2025 Guide - Master the complete investment framework

Related Investment Articles:

- What is Asset Tokenization? The Ultimate 2025 Beginner's Guide - Comprehensive beginner guide

- How to Start Investing in Tokenized Assets: 2025 Step-by-Step Guide - Getting started

- How to Invest in Tokenized Assets: Complete Step-by-Step Guide - Detailed steps

- Beginner's Guide to Investing in Tokenized Assets - Beginner-focused guide

Real-World Assets:

- Tokenizing Real-World Assets: Real Estate, Supply Chain & Finance in 2025 - Comprehensive RWA guide

- Startup Equity Tokenization: The Future of Fundraising - Startup equity

- Asset Tokenization ROI Calculator: 2025 Edition - ROI calculator

Next Steps:

- Start Investing with Pedex

- Contact Our Team - Get personalized guidance

Want to learn more? Explore our Investment Guide or contact our team.