How to Start Investing in Tokenized Assets: 2025 Step-by-Step Guide

Step-by-step investment guide: This article provides detailed instructions for getting started. For comprehensive investment guidance covering strategy, portfolio building, and returns, see How to Invest in Tokenized Assets: Complete 2025 Guide.

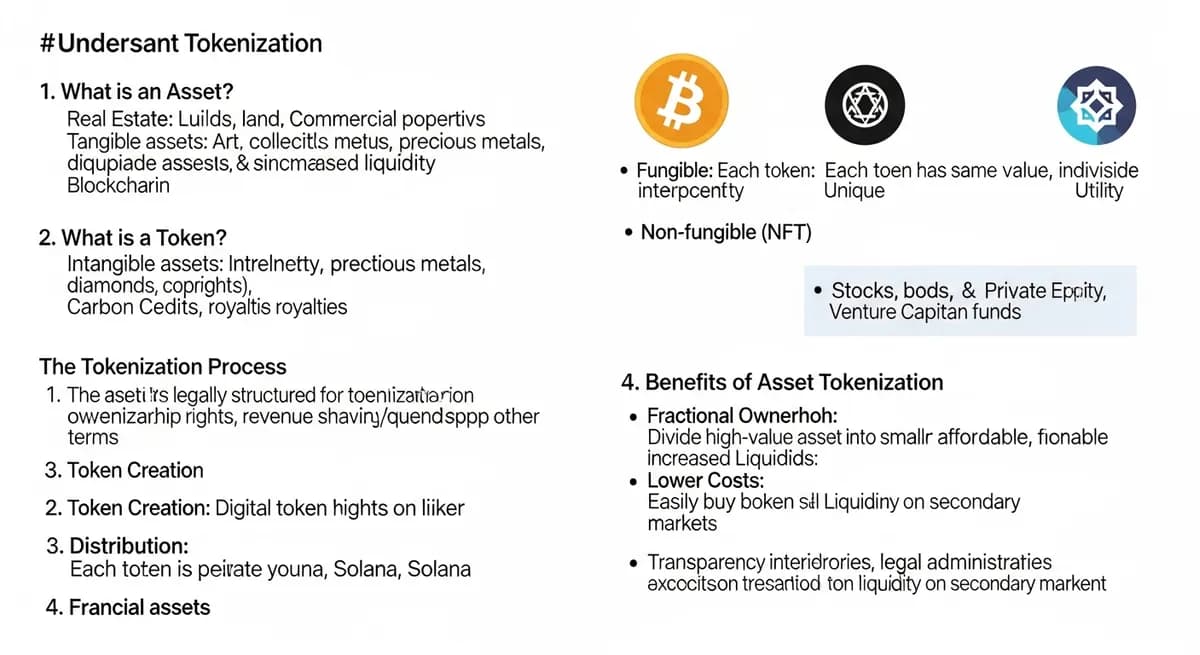

What is Tokenized Asset Investment?#

Tokenized asset investment involves purchasing digital tokens representing fractional ownership of real-world assets like real estate, securities, commodities, or infrastructure. These tokens are issued on blockchain platforms, enabling investors to own portions of assets previously requiring large minimum investments.

For comprehensive investment context, see our Ultimate Guide to Tokenization and RWA. New to RWAs? Read What are RWAs? Real World Assets Crypto Explained. For in-depth RWA investment strategies, see How to Invest in Tokenized Real World Assets. Learn fund strategies in our Tokenized Investment Funds guide, and explore banking applications in our RWA in Banking guide.

Key Points:#

- Tokenized assets represent fractional ownership of real-world assets

- Investments start as low as $1,000 (vs. $100,000+ traditionally)

- Tokens trade 24/7 on secondary markets

- Returns come from asset appreciation, rental income, or dividends

- Regulatory compliance ensures investor protection

Why Invest in Tokenized Assets?#

Access: Invest in premium assets (commercial real estate, private equity) with lower minimums.

Diversification: Own fractions of multiple assets across different sectors and geographies.

Liquidity: Trade tokens on secondary markets (vs. illiquid traditional investments).

Transparency: Blockchain provides transparent ownership records and asset performance data.

Passive Income: Receive rental income, dividends, or distributions from underlying assets.

Step-by-Step Investment Process#

Step 1: Education & Research (Week 1-2)#

Learn the Basics:

- Understand what tokenization is and how it works

- Learn about different asset types (real estate, securities, commodities)

- Research tokenization platforms and their features

- Understand regulatory requirements and investor qualifications

Resources:

- Read our comprehensive How to Invest in Tokenized Assets: Complete 2025 Guide for the full investment framework

- Learn the basics: What is Asset Tokenization?

- Review Investment Guide

- Watch educational videos

- Join investor communities

Time Investment: 10-20 hours over 1-2 weeks

Step 2: Choose a Platform (Week 2-3)#

Platform Selection Criteria:

- Regulatory compliance and licenses

- Asset types available

- Minimum investment amounts

- Fees and costs

- Secondary market liquidity

- User experience and support

Top Platforms to Consider:

- Pedex: Multi-asset types, GCC focus, low minimums

- Securitize: US securities, institutional focus

- Polymath: Developer-friendly, flexible

- Coinbase Prime: Crypto-native investors

Action Items:

- Research 3-5 platforms

- Compare features and fees

- Read reviews and case studies

- Request demos or consultations

Resources:

Step 3: Account Setup & KYC (Week 3-4)#

Account Registration:

- Visit platform website

- Click "Sign Up" or "Get Started"

- Provide email and create password

- Verify email address

KYC (Know Your Customer):

- Submit government-issued ID (passport, driver's license)

- Provide proof of address (utility bill, bank statement)

- Complete identity verification (video call or document upload)

- Answer compliance questions

Investor Accreditation (if required):

- Provide financial statements or tax returns

- Complete accreditation questionnaire

- Wait for approval (typically 1-3 business days)

Time to Complete: 1-3 business days for KYC, 3-7 days for accreditation

Step 4: Fund Your Account (Week 4)#

Funding Methods:

- Bank Transfer: Wire transfer or ACH (1-3 business days)

- Credit/Debit Card: Instant (may have limits)

- Cryptocurrency: Bitcoin, Ethereum (instant, may require conversion)

- Custody Wallet: Platform-managed wallet

Funding Considerations:

- Minimum funding requirements

- Fees for different payment methods

- Processing times

- Currency conversion (if applicable)

Security Best Practices:

- Use secure internet connection

- Enable two-factor authentication

- Verify recipient details before transferring

- Start with small amounts initially

Step 5: Browse Available Investments (Week 4-5)#

Asset Types to Explore:

- Real Estate: Commercial, residential, land

- Securities: Equity, debt, funds

- Commodities: Gold, oil, agricultural products

- Logistics: Vehicles, warehouses, equipment

- Financial Instruments: Invoices, receivables

Investment Evaluation:

- Asset Details: Location, type, value, condition

- Financial Performance: Historical returns, rental income, appreciation

- Risk Factors: Market risk, liquidity risk, operational risk

- Token Details: Price, supply, rights (voting, dividends)

- Platform Analysis: Issuer reputation, asset management

Questions to Ask:

- What is the underlying asset?

- What are historical returns?

- What are the risks?

- What rights do tokens provide?

- How liquid is the secondary market?

- Who manages the asset?

Step 6: Make Your First Investment (Week 5)#

Investment Process:

- Select investment opportunity

- Review investment details and documents

- Enter investment amount (check minimums)

- Review fees and costs

- Confirm investment

- Receive tokens in your account

First Investment Tips:

- Start with small amount ($1,000-$5,000)

- Choose well-established asset (proven track record)

- Diversify across asset types

- Read all documentation carefully

- Understand fees and costs

What Happens Next:

- Tokens appear in your account (typically within minutes)

- You receive confirmation email

- Asset performance updates available in dashboard

- Distributions/income paid according to schedule

Step 7: Monitor & Manage Portfolio (Ongoing)#

Portfolio Monitoring:

- Check asset performance regularly (weekly/monthly)

- Review income distributions

- Monitor secondary market prices

- Track overall portfolio value

Portfolio Management:

- Rebalance allocations as needed

- Add new investments over time

- Sell tokens on secondary market if needed

- Reinvest distributions for compound growth

Performance Tracking:

- Track returns (appreciation + income)

- Compare to benchmarks

- Calculate total return on investment

- Review tax implications

Investment Strategies#

Strategy 1: Conservative (Low Risk)#

Approach: Focus on stable, income-generating assets

Asset Types:

- Commercial real estate (office buildings, retail)

- Government bonds

- Infrastructure assets

- Blue-chip securities

Allocation: 70% income assets, 30% growth assets

Expected Returns: 5-8% annually

Best For: Investors seeking stable income and capital preservation

Strategy 2: Balanced (Moderate Risk)#

Approach: Mix of income and growth assets

Asset Types:

- Mixed real estate (commercial + residential)

- Diversified securities

- Commodities

- Logistics assets

Allocation: 50% income assets, 50% growth assets

Expected Returns: 8-12% annually

Best For: Investors seeking balanced growth and income

Strategy 3: Aggressive (High Risk)#

Approach: Focus on high-growth assets

Asset Types:

- Startup equity

- Emerging market real estate

- High-yield securities

- Speculative commodities

Allocation: 30% income assets, 70% growth assets

Expected Returns: 12-20% annually (with higher volatility)

Best For: Investors comfortable with risk seeking higher returns

Common Investment Mistakes to Avoid#

Mistake 1: Investing Without Research

- Impact: Poor investment choices, losses

- Solution: Research assets, platforms, and risks thoroughly

Mistake 2: Not Diversifying

- Impact: Concentration risk, higher volatility

- Solution: Diversify across asset types, geographies, sectors

Mistake 3: Ignoring Fees

- Impact: Lower net returns

- Solution: Understand all fees and factor into returns

Mistake 4: Chasing Returns

- Impact: Buying high, selling low

- Solution: Focus on long-term value, avoid emotional decisions

Mistake 5: Not Understanding Risks

- Impact: Unexpected losses

- Solution: Read risk disclosures, understand all risk factors

Mistake 6: Overinvesting

- Impact: Financial stress, inability to handle losses

- Solution: Only invest what you can afford to lose

Investment Calculator#

Use this framework to evaluate investments:

Investment Amount: $_______

Expected Annual Return: ___% (appreciation + income)

Fees: ___% (platform fees, custody fees)

Net Return: Expected Return - Fees = ___%

5-Year Projection:

- Year 1: $_______

- Year 2: $_______

- Year 3: $_______

- Year 4: $_______

- Year 5: $_______

Total Return: $_______

Tax Considerations#

Tax Treatment:

- Tokenized assets typically treated as securities for tax purposes

- Income distributions may be taxable

- Capital gains on token sales subject to capital gains tax

- Tax treatment varies by jurisdiction

Tax Planning:

- Consult tax advisor familiar with tokenized assets

- Keep records of all transactions

- Report income and gains accurately

- Consider tax-efficient strategies

Important: Tax laws vary by jurisdiction. Consult qualified tax advisor.

Tax Guidance: See our comprehensive Tokenization Tax Guide 2025 for detailed tax information by jurisdiction, including US, UK, EU, and GCC tax treatment.

Frequently Asked Questions#

Q: What is the minimum investment? A: Typically $1,000-$5,000 depending on platform and asset. Some platforms allow investments as low as $500.

Q: How do I get returns? A: Returns come from asset appreciation (token price increase) and income distributions (rental income, dividends). Distributions are typically paid monthly, quarterly, or annually.

Q: Can I sell my tokens? A: Yes, on most platforms you can sell tokens on secondary markets. Liquidity varies by asset and platform.

Q: How liquid are tokenized assets? A: Liquidity depends on asset type and platform. Real estate tokens may have lower liquidity than securities tokens. Check platform's secondary market activity.

Q: What are the risks? A: Risks include asset value decline, liquidity risk, platform risk, regulatory risk, and technology risk. Read risk disclosures carefully.

Q: Do I need to be accredited? A: Depends on asset type and jurisdiction. Some tokenized assets require accredited investor status. Platforms will verify during onboarding.

Q: How are fees structured? A: Fees typically include platform fees (0.5-2% per transaction), custody fees (0.1-0.5% annually), and potentially management fees. Review fee structure before investing.

Q: Can I invest from any country? A: Depends on platform and jurisdiction. Some platforms serve global investors, others are jurisdiction-specific. Check platform's geographic restrictions.

Q: How do I track performance? A: Platforms provide dashboards showing asset performance, token value, income distributions, and portfolio value. You can also track on blockchain explorers.

Q: What happens if platform shuts down? A: Your tokens remain on blockchain, but you'll need another platform for management. Choose platforms with proven track records and regulatory compliance.

Getting Started Checklist#

- Educate yourself on tokenization basics

- Research and choose a platform

- Complete account registration and KYC

- Fund your account

- Browse available investments

- Make first investment (start small)

- Monitor portfolio performance

- Continue learning and investing

Next Steps#

Ready to Start?

- Read What is Asset Tokenization?

- Review Platform Comparison

- Sign up for Pedex and start investing

Learn More: Investing in Tokenized Assets#

Comprehensive Investment Guide:

→ How to Invest in Tokenized Assets: Complete 2025 Guide - Master the complete investment framework

Related Investment Articles:

- Tokenized Asset Investment Returns: Real Data from 2024 - Understand returns

- Building a Tokenized Investment Portfolio: Diversification Guide - Portfolio strategies

- Minimum Investment in Tokenized Real Estate: What You Need - Investment minimums

- What is Asset Tokenization? The Ultimate 2025 Beginner's Guide - Fundamentals

Platform & Security:

- Best Tokenization Platforms 2025: Enterprise Comparison Guide - Choose the right platform

- Tokenization Platform Security: What Investors Need to Know - Security guide

Next Steps:

- Sign up for Pedex and start investing

- Contact Our Investment Team for personalized guidance

Ready to Start Investing?#

Ready to Start Investing?

Join thousands of investors building wealth through tokenized assets. Start with as little as $100.

This guide is for educational purposes only. Not financial advice. Consult qualified financial advisor before investing.