How to Choose an Asset Tokenization Platform: 15 Critical Factors

Platform selection guide: This article covers selection criteria. For comprehensive platform comparison and enterprise guidance, see Best Tokenization Platforms 2025: Enterprise Comparison Guide.

What is Platform Selection?#

Platform selection is the process of evaluating and choosing a tokenization platform that matches your asset type, target market, regulatory requirements, and budget. The right platform ensures compliant tokenization, investor access, and ongoing asset management.

For comprehensive context, see our Ultimate Guide to Tokenization and RWA. Learn about compliance requirements in our Tokenization Legal Structure guide.

Key Points:#

- Platform selection requires evaluating 15+ factors beyond just cost

- Different platforms excel in different asset types and markets

- Regulatory compliance is non-negotiable and varies by jurisdiction

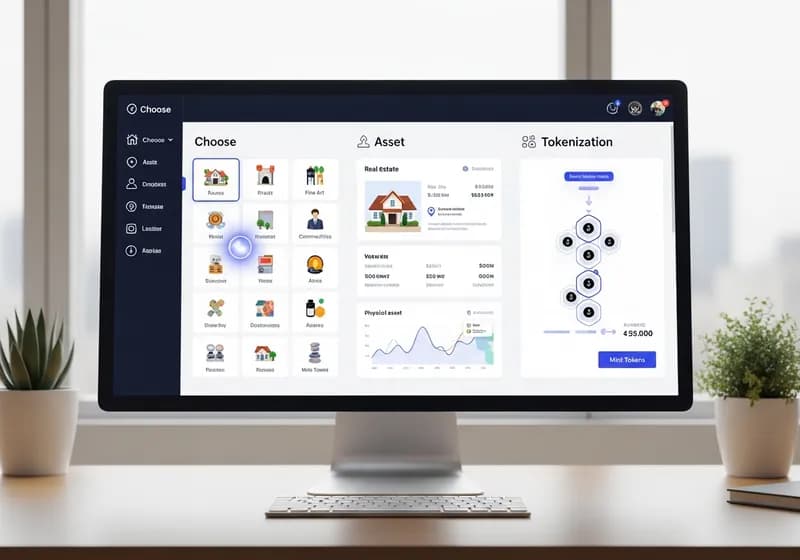

- Total cost of ownership includes setup, fees, and ongoing expenses

Why Platform Selection Matters#

Wrong Choice Consequences:

- Regulatory violations and legal issues

- Higher costs than necessary

- Limited investor access

- Poor secondary market liquidity

- Technical limitations blocking growth

Right Choice Benefits:

- Smooth regulatory compliance

- Optimal cost structure

- Access to target investors

- Strong secondary market

- Scalable infrastructure

15 Critical Factors for Platform Selection#

1. Asset Type Support#

What to Check: Does the platform support your specific asset type?

Asset Types:

- Real Estate (residential, commercial, land)

- Securities (equity, debt, funds)

- Commodities (gold, oil, agricultural)

- Logistics (vehicles, warehouses, equipment)

- Financial Instruments (invoices, receivables)

- Intellectual Property (patents, trademarks)

Questions to Ask:

- How many [your asset type] tokenizations has platform completed?

- Can you provide case studies for similar assets?

- Are there any asset type restrictions?

Red Flags: Platform has never tokenized your asset type before

Best Practice: Choose platforms with proven experience in your asset type

2. Regulatory Compliance#

What to Check: Is the platform licensed and compliant in your target markets?

Key Jurisdictions:

- US: SEC registration, state licenses

- GCC: VARA (UAE), SAMA (Saudi), QFC (Qatar)

- UK: FCA authorization

- Singapore: MAS licensing

- Switzerland: FINMA approval

Questions to Ask:

- What licenses does platform hold?

- Can platform operate in [your jurisdiction]?

- Who handles regulatory filings?

- What happens if regulations change?

Red Flags: Platform claims compliance but can't show licenses

Best Practice: Verify licenses independently with regulators

3. Total Cost of Ownership#

What to Check: All costs including setup, fees, and ongoing expenses

Cost Components:

- Setup Costs: $10K - $500K (one-time)

- Transaction Fees: 0.1% - 3% per transaction

- Monthly Platform Fees: $2K - $30K

- Custody Fees: 0.1% - 0.5% annually

- Compliance Costs: Varies by jurisdiction

- Legal Costs: $20K - $100K (one-time)

Questions to Ask:

- What is the total setup cost (all-inclusive)?

- What are all ongoing fees?

- Are there hidden costs?

- What happens if transaction volume increases?

Red Flags: Platform only quotes setup cost, hides fees

Best Practice: Get written cost breakdown for 3-year projection

4. Secondary Market & Liquidity#

What to Check: Does platform provide trading infrastructure and liquidity?

Liquidity Factors:

- Built-in exchange vs. partner exchange

- Trading volume and frequency

- Market maker presence

- Order book depth

- Settlement speed

Questions to Ask:

- Does platform have built-in secondary market?

- What is average daily trading volume?

- How quickly can investors sell tokens?

- Are there market makers?

Red Flags: No secondary market, or very low trading volume

Best Practice: Choose platforms with active secondary markets

5. Investor Network & Access#

What to Check: Does platform provide access to your target investors?

Investor Types:

- Institutional investors

- Accredited investors

- Retail investors

- Geographic distribution

- Industry focus

Questions to Ask:

- How many investors are on platform?

- What is investor geographic distribution?

- Can platform help with investor marketing?

- What is average investment size?

Red Flags: Platform has no investor network or can't verify numbers

Best Practice: Ask for investor demographics and case studies

6. Technical Architecture & Integration#

What to Check: Can platform integrate with your existing systems?

Technical Considerations:

- API availability and documentation

- Webhook support

- Data export capabilities

- Blockchain support (Ethereum, Polygon, etc.)

- Smart contract standards (ERC-3643, ERC-1400)

Questions to Ask:

- Is there a developer API?

- Can we integrate with our CRM/accounting systems?

- What blockchain networks are supported?

- Can we customize smart contracts?

Red Flags: No API, closed system, vendor lock-in

Best Practice: Request API documentation and test integration

7. Security & Custody#

What to Check: How are assets and tokens secured?

Security Factors:

- Custody provider (qualified custodian)

- Insurance coverage

- Multi-signature wallets

- Cold storage for keys

- Security audits and certifications

Questions to Ask:

- Who is the custodian?

- Is custodian licensed/regulated?

- What insurance coverage exists?

- When was last security audit?

- What certifications does platform have (SOC 2, ISO 27001)?

Red Flags: No qualified custodian, no insurance, no audits

Best Practice: Verify custodian licenses and insurance independently

8. Smart Contract Standards#

What to Check: What token standards and compliance features are used?

Common Standards:

- ERC-3643: Security token standard with compliance

- ERC-1400: Security token standard

- ERC-1155: Multi-token standard

- Custom: Platform-specific standards

Questions to Ask:

- What token standard is used?

- Are smart contracts audited?

- Can compliance rules be updated?

- What happens if standard changes?

Red Flags: No standard, unaudited contracts, can't update compliance

Best Practice: Choose platforms using audited, standard tokens

9. User Experience & Interface#

What to Check: Is platform easy for investors and administrators to use?

UX Considerations:

- Investor portal quality

- Admin dashboard functionality

- Mobile app availability

- Multi-language support

- Accessibility compliance

Questions to Ask:

- Can we see demo of investor portal?

- Is there mobile app?

- What languages are supported?

- Is platform accessible (WCAG)?

Red Flags: Poor UX, no mobile support, English-only

Best Practice: Request demo accounts and test with real users

10. Customer Support & Service#

What to Check: What level of support does platform provide?

Support Factors:

- Response time (SLA)

- Support channels (email, phone, chat)

- Dedicated account manager

- Training and documentation

- Support hours (24/7 vs. business hours)

Questions to Ask:

- What is support response time SLA?

- Is there dedicated account manager?

- What training is provided?

- Is support available 24/7?

Red Flags: Slow response times, no dedicated support, poor documentation

Best Practice: Test support responsiveness before signing

11. Track Record & References#

What to Check: What is platform's history of successful tokenizations?

Track Record Metrics:

- Number of completed tokenizations

- Total value tokenized

- Asset types tokenized

- Geographic coverage

- Client retention rate

Questions to Ask:

- How many tokenizations has platform completed?

- What is total value tokenized?

- Can you provide 3-5 client references?

- What is client retention rate?

Red Flags: No track record, can't provide references, high churn

Best Practice: Speak with 3+ existing clients independently

12. Scalability & Growth#

What to Check: Can platform handle your growth plans?

Scalability Factors:

- Transaction throughput

- Investor capacity

- Multi-asset support

- Geographic expansion

- Feature roadmap

Questions to Ask:

- What is maximum transaction volume?

- How many investors can platform support?

- Can we tokenize multiple assets?

- What is product roadmap?

Red Flags: Platform can't scale, no roadmap, limited capacity

Best Practice: Plan for 3-5x growth and verify platform capacity

13. White-Label Options#

What to Check: Can platform be white-labeled for your brand?

White-Label Considerations:

- Brand customization level

- Domain customization

- UI/UX customization

- API access for custom frontend

- Pricing for white-label

Questions to Ask:

- Is white-label available?

- What can be customized?

- Can we use our domain?

- What is white-label pricing?

Red Flags: No white-label, very limited customization

Best Practice: If branding matters, verify white-label capabilities early

14. Geographic & Language Support#

What to Check: Does platform support your target markets and languages?

Geographic Factors:

- Supported jurisdictions

- Local language support

- Local payment methods

- Currency support

- Time zone support

Questions to Ask:

- What jurisdictions are supported?

- What languages are available?

- What payment methods are supported?

- What currencies are supported?

Red Flags: No support for your markets/languages

Best Practice: Verify support for all target markets before signing

15. Exit Strategy & Portability#

What to Check: What happens if you want to leave platform?

Exit Considerations:

- Data export capabilities

- Token portability

- Contract termination terms

- Migration support

- Ongoing token management

Questions to Ask:

- Can we export all data?

- Can tokens be moved to another platform?

- What are termination terms?

- What happens to tokens after exit?

Red Flags: Vendor lock-in, can't export data, high exit costs

Best Practice: Understand exit terms before signing, plan for portability

Platform Selection Checklist#

Use this comprehensive checklist when evaluating platforms:

Regulatory & Compliance#

- Platform licensed in target jurisdictions

- Compliance team available

- Regulatory filings handled by platform

- Insurance coverage adequate

Costs#

- Setup cost within budget

- Transaction fees acceptable

- Monthly fees reasonable

- Total 3-year cost calculated

- No hidden fees

Technical#

- Asset type supported

- API available and documented

- Integration possible with existing systems

- Smart contracts audited

- Blockchain network suitable

Market & Liquidity#

- Secondary market available

- Trading volume adequate

- Investor network matches target

- Geographic coverage sufficient

Service & Support#

- Track record proven

- References available

- Support SLA acceptable

- Training provided

- Documentation complete

Future-Proofing#

- Scalability adequate

- Roadmap aligned with needs

- Exit strategy clear

- Data portability possible

Decision Framework#

Step 1: Define Requirements (Week 1)#

- Asset type and characteristics

- Target markets and jurisdictions

- Investor profile and requirements

- Budget constraints

- Technical requirements

- Timeline expectations

Step 2: Research Platforms (Week 2-3)#

- Identify 5-10 potential platforms

- Review websites and documentation

- Check regulatory licenses

- Read reviews and case studies

Step 3: Shortlist (Week 3-4)#

- Narrow to 3-5 platforms

- Request demos

- Get pricing quotes

- Check references

Step 4: Evaluate (Week 4-6)#

- Score each platform on 15 factors

- Compare total cost of ownership

- Test APIs and integrations

- Speak with existing clients

Step 5: Decision (Week 6-7)#

- Select platform

- Negotiate contract

- Plan implementation

- Begin onboarding

Common Mistakes to Avoid#

Mistake 1: Choosing based on price alone

- Impact: Higher total costs, poor service

- Solution: Evaluate total cost of ownership

Mistake 2: Ignoring regulatory requirements

- Impact: Legal issues, inability to operate

- Solution: Verify licenses independently

Mistake 3: Not checking track record

- Impact: Platform fails, project delayed

- Solution: Speak with 3+ existing clients

Mistake 4: Overlooking secondary market

- Impact: Investors can't exit, poor liquidity

- Solution: Verify trading volume and liquidity

Mistake 5: Not planning for growth

- Impact: Platform can't scale, migration needed

- Solution: Plan for 3-5x growth capacity

Mistake 6: Ignoring exit strategy

- Impact: Vendor lock-in, high exit costs

- Solution: Understand exit terms upfront

Platform Comparison Template#

Use this template to compare platforms:

| Factor | Platform A | Platform B | Platform C |

|---|---|---|---|

| Asset Type Support | |||

| Regulatory Compliance | |||

| Setup Cost | |||

| Transaction Fees | |||

| Monthly Fees | |||

| Secondary Market | |||

| Investor Network | |||

| API Available | |||

| Security/Custody | |||

| Track Record | |||

| Support Quality | |||

| Scalability | |||

| Total Score |

Getting Started#

Immediate Actions:

- Define your requirements (asset type, markets, budget)

- Research 5-10 platforms

- Request demos from top 3

- Evaluate using this 15-factor framework

- Make decision and begin onboarding

Resources:

Frequently Asked Questions#

Q: How long does platform selection take? A: Typically 4-8 weeks from research to decision. Allow 2-3 weeks for demos, 1-2 weeks for evaluation, and 1-2 weeks for contract negotiation.

Q: Should I choose the cheapest platform? A: Not necessarily. Consider total cost of ownership, regulatory compliance, and service quality. Cheapest platforms may lack features or regulatory support.

Q: Can I use multiple platforms? A: Yes, but it adds complexity and costs. Most organizations choose one primary platform. Some use multiple platforms for different asset types or markets.

Q: What if I choose the wrong platform? A: You can migrate to another platform, but it's costly and time-consuming. Choose carefully from the start. Most platforms allow data export.

Q: Do I need technical expertise to evaluate platforms? A: Basic understanding helps, but platforms should provide demos and support. Consider hiring a consultant if you lack technical expertise.

Q: How do I verify platform claims? A: Check licenses with regulators, speak with existing clients, review case studies, test APIs, and get everything in writing.

Q: What is most important factor? A: Regulatory compliance is non-negotiable. After that, match platform capabilities to your specific needs (asset type, market, investors).

Q: Can I negotiate platform pricing? A: Yes, especially for larger projects or multi-asset deals. Most platforms are willing to negotiate setup costs and fees.

Learn More: Enterprise Tokenization Platforms#

🎯 Central Hub:

→ Best Tokenization Platforms 2025: Enterprise Guide — Complete enterprise platform analysis

Deep-Dive Authority Guides#

Financial Analysis:

- ROI & Financial Modeling — TCO, NPV, IRR, break-even analysis

- Enterprise Costs 2025 — Detailed cost breakdown

Security & Compliance:

- Regulatory Landscape 2025 — Global compliance framework

- Custody Models Guide — Self, third-party, hybrid solutions

Risk Management:

- Why Platforms Fail — Case studies, red flags, due diligence

Platform Selection Resources#

- Best Platforms: Buyer's Guide — Detailed platform reviews

- Platform Comparison 2025 — Feature comparison matrix

- Best Platforms by Use Case — Real estate, PE, debt, infrastructure

- Platform vs Traditional Finance — Strategic comparison

Technical Resources#

- Platform Architecture — Technical deep-dive

- API Integration Guide — Developer documentation

- Enterprise Requirements — Must-have features

- White-Label: Build vs Buy — Build vs buy analysis

Visual Learning#

- Video Guide 2025 — Live demos and walkthroughs

Asset Selection:

- Choosing Assets to Tokenize: Decision Framework - Asset selection guide

Next Steps:

- Contact Pedex for Consultation - Get expert platform selection guidance

- Request a Demo - See the platform in action

This guide is updated regularly. Last updated: January 2025.