Custody Models in Tokenization Platforms: Self, Third-Party & Hybrid Solutions

Digital asset custody is the foundation of any secure tokenization platform. Unlike traditional securities held by centralized clearinghouses, tokenized assets exist on blockchain—making custody infrastructure both critical and complex.

This comprehensive guide examines custody models, security architectures, regulatory requirements, and how enterprises should evaluate custody solutions when selecting a tokenization platform.

Enterprise Platform Guide: This article is part of our comprehensive tokenization coverage. For platform selection, see Best Tokenization Platforms 2025: Enterprise Guide.

Table of Contents#

- What is Digital Asset Custody?

- Why Custody Matters

- Custody Model Comparison

- Self-Custody Solutions

- Third-Party Custody

- Hybrid Custody Models

- Bank-Grade Custody Requirements

- Key Management Systems

- Cold Storage vs Hot Wallets

- Multi-Signature Architectures

- Insurance and Protection

- Regulatory Custody Requirements

- Custody Provider Comparison

- Custody Due Diligence Checklist

- Future of Custody

What is Digital Asset Custody?#

Digital asset custody refers to the secure storage and management of private keys that control blockchain-based tokens. In tokenization:

Traditional Securities Custody:

- Assets held by broker/custodian

- DTCC clearinghouse system

- Multiple intermediaries

- Centralized records

Tokenized Asset Custody:

- Private keys control ownership

- Direct blockchain settlement

- Self or delegated custody

- Decentralized verification

The Custody Challenge#

Unlike traditional assets, blockchain tokens are controlled entirely by private keys:

Private Key → Controls Tokens

Lost Key = Lost Assets (permanently)

Stolen Key = Stolen Assets (irreversible)

This creates unique challenges:

- No "forgot password" recovery

- No chargebacks or reversals

- Immutable transactions

- Target for sophisticated attacks

Why Custody Matters#

Enterprise Requirements#

Institutional investors demand custody solutions that provide:

- Security: Protection against theft, loss, and insider threats

- Compliance: Regulatory-approved custody arrangements

- Insurance: Coverage for digital asset holdings

- Auditability: Clear chain of custody for audit trails

- Operational Controls: Separation of duties, approvals, limits

Custody Incidents (Lessons Learned)#

| Incident | Year | Loss | Cause |

|---|---|---|---|

| Mt. Gox | 2014 | $450M | Hot wallet compromise |

| Quadriga | 2019 | $190M | Lost private keys (sole holder) |

| Poly Network | 2021 | $600M | Smart contract exploit |

| FTX | 2022 | $8B | Custodial fraud (no segregation) |

| Atomic Wallet | 2023 | $100M | Software vulnerability |

Key Takeaway: Custody failures are existential. Platforms must prioritize custody above all else.

Custody Model Comparison#

Three Primary Models#

| Model | Control | Security | Complexity | Best For |

|---|---|---|---|---|

| Self-Custody | Full control | You responsible | High | Technical teams |

| Third-Party | Delegated | Custodian responsible | Low | Institutional investors |

| Hybrid | Shared | Distributed risk | Medium | Enterprise platforms |

Detailed Comparison#

| Factor | Self-Custody | Third-Party | Hybrid |

|---|---|---|---|

| Private Key Control | Internal | External | Multi-party |

| Operational Burden | High | Low | Medium |

| Insurance | Self-procure | Included | Varies |

| Regulatory Acceptance | Limited | High | High |

| Cost | Infrastructure + staff | % of AUM | Mid-range |

| Recovery Options | Internal backup | Provider recovery | Multi-sig recovery |

| Attack Surface | Internal threats | Provider breach | Distributed risk |

Self-Custody Solutions#

What is Self-Custody?#

Platform or enterprise holds private keys internally using dedicated infrastructure.

Architecture#

Typical Setup:

Hardware Security Modules (HSMs)

↓

Multi-Signature Wallets

↓

Cold Storage (Offline)

↓

Hot Wallets (Operations)

Advantages#

✅ Full Control: No third-party dependencies

✅ No Custodian Fees: Save 0.5-2% annually

✅ Immediate Access: No approval delays

✅ Custom Workflows: Tailored to your processes

✅ Privacy: No external visibility

Disadvantages#

❌ Technical Complexity: Requires specialized expertise

❌ Operational Burden: 24/7 security operations

❌ Insurance Challenges: Expensive or unavailable

❌ Regulatory Uncertainty: May not meet institutional requirements

❌ Single Point of Failure: Internal compromise risk

❌ Staff Risk: Key personnel turnover or malfeasance

When to Use Self-Custody#

Good Fit:

- Technical teams with crypto/security expertise

- Small-to-medium AUM (<$50M)

- Short-term or pilot projects

- Utility tokens (lower value)

Poor Fit:

- Institutional investor requirements

- Large AUM (>$100M)

- Regulated security tokens

- Enterprises without security expertise

Self-Custody Technology Stack#

Hardware Security Modules (HSM):

- Thales nShield

- Utimaco CryptoServer

- AWS CloudHSM

- Azure Key Vault HSM

Key Management Software:

- HashiCorp Vault

- Unbound Security

- Ledger Vault (enterprise)

- Fireblocks (infrastructure provider)

Multi-Signature Solutions:

- Gnosis Safe (Ethereum)

- Multi-sig scripts (Bitcoin)

- Threshold signatures (advanced)

Third-Party Custody#

What is Third-Party Custody?#

Specialized custodian holds private keys on behalf of the platform/enterprise.

How It Works#

- Onboarding: Platform opens custody account

- Deposit: Tokens transferred to custodian-controlled addresses

- Segregation: Assets held separately from custodian's holdings

- Instructions: Platform submits withdrawal requests

- Execution: Custodian executes after verification

Qualified vs Non-Qualified Custodians#

Qualified Custodians (regulatory definition):

- Banks

- Broker-dealers

- Futures commission merchants

- Certain trust companies

- SEC-registered custodians

Examples:

- Coinbase Custody (qualified)

- Fidelity Digital Assets (qualified)

- BitGo Trust (qualified)

- Anchorage Digital (qualified)

Advantages#

✅ Regulatory Compliance: Meets institutional standards

✅ Insurance: Typically $100M-$1B+ coverage

✅ Expertise: Dedicated security professionals

✅ Audited: Regular SOC 2, SOC 1 audits

✅ Brand Trust: Recognized by institutional investors

✅ Operational Simplicity: Custodian handles infrastructure

Disadvantages#

❌ Cost: 0.5-2% of AUM annually

❌ Counterparty Risk: Custodian failure or fraud

❌ Withdrawal Delays: Approval processes take time

❌ Limited Control: Subject to custodian policies

❌ Geographic Restrictions: May not support all jurisdictions

Custody Fee Structure#

| Custodian Type | Setup Fee | Annual Fee | Transaction Fee |

|---|---|---|---|

| Tier 1 (Coinbase, Fidelity) | $100K-500K | 0.5-1.5% AUM | $50-200/tx |

| Tier 2 (BitGo, Anchorage) | $50K-200K | 1-2% AUM | $25-100/tx |

| Tier 3 (Smaller providers) | $10K-50K | 1.5-3% AUM | $10-50/tx |

When to Use Third-Party Custody#

Good Fit:

- Institutional investor requirements

- Large AUM (>$100M)

- Regulated security tokens

- Enterprises without internal expertise

- Risk-averse organizations

Poor Fit:

- Very low AUM (<$1M) — fees disproportionate

- Need for instant withdrawals

- Budget constraints

- Custom operational requirements

Hybrid Custody Models#

What is Hybrid Custody?#

Combination of self-custody and third-party custody, often using multi-signature schemes.

Common Hybrid Architectures#

2-of-3 Multi-Sig:

- Platform holds 1 key

- Custodian holds 1 key

- Backup key (cold storage/escrow)

- Any 2 keys required to move assets

3-of-5 Multi-Sig (Enterprise):

- Platform: 2 keys (different individuals)

- Custodian: 2 keys

- Independent director/auditor: 1 key

- Any 3 keys required

Threshold Signatures (Advanced):

- Distributed key generation

- No single complete key exists

- Mathematical threshold required

- More secure than traditional multi-sig

Advantages#

✅ Distributed Risk: No single point of failure

✅ Enhanced Security: Multiple parties must collude

✅ Operational Flexibility: Platform retains some control

✅ Regulatory Acceptance: Third-party involvement satisfies requirements

✅ Cost Efficiency: Lower than pure third-party

✅ Disaster Recovery: Multiple backup paths

Disadvantages#

❌ Complexity: More moving parts

❌ Coordination: Multiple parties for transactions

❌ Cost: More expensive than pure self-custody

❌ Key Management: Multiple systems to maintain

When to Use Hybrid Custody#

Ideal For:

- Enterprise platforms

- AUM $10M-$100M

- Balance of control and security

- Institutional investor needs + operational control

- Regulatory compliance + cost efficiency

Hybrid Custody Providers#

- Fireblocks MPC: Multi-party computation custody

- Curv MPC: Threshold signatures (acquired by PayPal)

- Copper: ClearLoop multi-sig custody

- Ledger Enterprise: Vault with governance rules

Bank-Grade Custody Requirements#

What Qualifies as "Bank-Grade"?#

Custody meeting standards comparable to traditional financial institutions:

Security Requirements#

Physical Security:

- SOC 2 Type II certified data centers

- Biometric access controls

- 24/7 security monitoring

- Geographically distributed facilities

- Disaster recovery sites

Logical Security:

- Hardware Security Modules (HSMs)

- Encryption at rest and in transit

- Multi-factor authentication

- IP whitelisting

- DDoS protection

Operational Security:

- Segregation of duties

- Maker-checker workflows

- Transaction limits and velocity controls

- Anomaly detection

- Incident response plans

Compliance Requirements#

- SOC 1 Type II (financial controls)

- SOC 2 Type II (security controls)

- ISO 27001 (information security)

- PCI DSS (if handling payment cards)

- Regular penetration testing

- Third-party audits

Insurance Requirements#

Minimum coverage expectations:

- Crime Insurance: $100M+ (theft, fraud)

- Errors & Omissions: $50M+

- Cyber Insurance: $25M+

- Cold Storage: Typically higher coverage

- Hot Wallets: May have lower sub-limits

Key Management Systems#

Key Lifecycle Management#

Generation:

- True random number generation

- Secure enclave/HSM generation

- Ceremony with witnesses (for critical keys)

- Entropy verification

Storage:

- Encrypted at rest

- Access control lists

- Hardware security modules

- Geographic distribution

Usage:

- Authentication required

- Transaction signing

- Audit logging

- Rate limiting

Rotation:

- Regular key rotation schedule

- Emergency rotation procedures

- Migration to new addresses

- Historical key archival

Destruction:

- Secure deletion protocols

- After asset migration

- Compliance with data retention

- Provable destruction

Hardware Security Modules (HSMs)#

HSMs provide tamper-resistant key storage:

Enterprise HSMs:

| Vendor | Model | FIPS Level | Use Case |

|---|---|---|---|

| Thales | nShield Connect | FIPS 140-2 L3 | Enterprise |

| Utimaco | CryptoServer Se | FIPS 140-2 L4 | High security |

| AWS | CloudHSM | FIPS 140-2 L3 | Cloud |

| Azure | Key Vault HSM | FIPS 140-2 L2 | Cloud |

Key Features:

- Tamper detection triggers key zeroization

- Cryptographic operations performed inside HSM

- Keys never leave device in plaintext

- Physical security controls

Backup and Recovery#

Backup Strategies:

- Seed Phrase: 12-24 word mnemonic (BIP-39)

- Encrypted Backup: Key material encrypted with master key

- Multi-Location: Geographically distributed backups

- Time-Lock: Delayed access for compromised backups

- Social Recovery: Distributed shares (Shamir Secret Sharing)

Recovery Testing:

- Regular disaster recovery drills

- Documented recovery procedures

- Time-to-recovery metrics

- Independent verification

Cold Storage vs Hot Wallets#

Cold Storage (Offline)#

Definition: Private keys never connected to internet.

Use Cases:

- Long-term holding (>95% of assets)

- Infrequent withdrawals

- Maximum security

Technologies:

- Hardware wallets (Ledger, Trezor)

- Air-gapped computers

- Paper wallets (deprecated)

- Steel wallets (physical backups)

- Multi-sig vaults

Typical Allocation: 95-99% of total assets

Hot Wallets (Online)#

Definition: Private keys on internet-connected systems.

Use Cases:

- Daily operations

- Investor withdrawals

- Trading activities

- Platform liquidity

Technologies:

- HSM-backed wallets

- Cloud key management

- Mobile/web wallets

- Exchange wallets

Typical Allocation: 1-5% of total assets

Warm Wallets (Semi-Offline)#

Middle ground between cold and hot:

- Keys in HSMs requiring manual intervention

- Air-gapped signing devices

- Multi-sig with cold key required

- Delayed withdrawal systems

Asset Allocation Strategy#

| Asset Value | Cold Storage | Warm | Hot | Rationale |

|---|---|---|---|---|

| < $1M | 80% | 10% | 10% | Lower overhead |

| $1M-$10M | 90% | 5% | 5% | Balanced |

| $10M-$100M | 95% | 3% | 2% | High security |

| > $100M | 98% | 1.5% | 0.5% | Maximum security |

Multi-Signature Architectures#

How Multi-Sig Works#

Transaction Proposal

↓

Signature #1 (Party A)

↓

Signature #2 (Party B)

↓

Threshold Met (e.g., 2-of-3)

↓

Transaction Broadcast

Common Multi-Sig Configurations#

| Configuration | Description | Use Case |

|---|---|---|

| 2-of-2 | Both parties must sign | Simple partnerships |

| 2-of-3 | Any 2 of 3 keys | Standard enterprise |

| 3-of-5 | Any 3 of 5 keys | Large organizations |

| M-of-N | M of N keys | Custom requirements |

Multi-Sig Best Practices#

Key Distribution:

- Different individuals hold different keys

- Geographic distribution (different locations)

- Different storage media (HSM + hardware wallet)

- No single person should hold >1 key

Governance:

- Clear approval policies

- Transaction limits by threshold

- Emergency procedures

- Regular key holder audits

Platform Support:

- Bitcoin: Native support since 2012

- Ethereum: Smart contract multi-sig (Gnosis Safe)

- Other chains: Varying levels of support

Advanced: Threshold Signatures#

Instead of separate signatures, threshold schemes use distributed key generation:

Advantages:

- Single signature on-chain (privacy, cost)

- No smart contract required

- More flexible than traditional multi-sig

- Better scalability

Technologies:

- ECDSA threshold signatures

- Schnorr signatures (Bitcoin Taproot)

- BLS signatures

- MPC (Multi-Party Computation)

Insurance and Protection#

Types of Coverage#

Crime/Theft Insurance:

- External hacks

- Insider theft

- Social engineering

- Physical theft

Errors & Omissions:

- Operational errors

- System failures

- Wrong address sends

- Software bugs

Cyber Insurance:

- Data breaches

- Ransomware

- DDoS attacks

- Business interruption

Coverage Limits by Custodian Type#

| Custodian Type | Typical Coverage | Details |

|---|---|---|

| Tier 1 (Coinbase, Fidelity) | $255M-$750M | Lloyd's of London + reinsurance |

| Tier 2 (BitGo, Anchorage) | $100M-$200M | Syndicated coverage |

| Tier 3 (Smaller) | $10M-$50M | Limited coverage |

| Self-Custody | $0-$10M | Very expensive if available |

What Insurance Doesn't Cover#

❌ Loss due to user error

❌ Voluntary transfer (no coercion)

❌ Private key disclosure

❌ Unauthorized access you enabled

❌ Market value decline

❌ Smart contract bugs (usually)

Insurance Cost#

- Self-custody: 2-5% of coverage amount annually

- Third-party custodian: Included in custody fee

- Warm/Hot wallet coverage: Higher premiums than cold

- Higher deductibles for smaller policies

Regulatory Custody Requirements#

US Requirements#

SEC Custody Rule (Rule 206(4)-2):

- Qualified custodian required for RIAs

- Surprise audits annually

- Account statements to investors

- Applies to security tokens under management

Qualified Custodians must be:

- Banks

- Savings associations

- Registered broker-dealers

- Registered futures commission merchants

- Foreign financial institutions

EU Requirements (MiCA)#

Crypto-Asset Service Providers (CASPs):

- Custody services require authorization

- Safeguarding obligations

- Segregation of client assets

- Insurance or comparable guarantee

UAE Requirements#

VARA (Dubai):

- Licensed custody service provider

- Segregation of client assets

- Insurance requirements

- Operational resilience standards

DIFC (DFSA):

- Custody arrangements for security tokens

- Client asset protection

- Insurance minimums

Singapore Requirements#

MAS Framework:

- Capital Markets Services license (for securities)

- Trust license (for custody services)

- Technology risk management

- Business continuity management

Custody Provider Comparison#

Top Qualified Custodians#

| Provider | Assets Under Custody | Insurance | Jurisdictions | Specialization |

|---|---|---|---|---|

| Coinbase Custody | $130B+ | $255M+ | 100+ countries | Institutional |

| Fidelity Digital Assets | Undisclosed | $400M+ | US, EU | Traditional finance |

| BitGo | $64B+ | $100M | Global | Multi-asset |

| Anchorage Digital | $20B+ | $200M | US | Federally chartered |

| Copper | $2B+ | $125M | EU, Asia | Prime services |

| Fireblocks | $3T+ transacted | $400M+ | Global | Infrastructure |

Evaluation Criteria#

Security Track Record:

- Years in operation without breach

- Insurance claims history

- Audit reports publicly available

- Penetration test results

Regulatory Standing:

- Licenses held

- Regulatory actions (if any)

- Compliance certifications

- Qualified custodian status

Technology:

- Multi-sig support

- Cold storage percentage

- Transaction processing time

- API capabilities

Operational:

- Customer support quality

- SLA commitments

- Geographic coverage

- Asset support (which tokens)

Custody Due Diligence Checklist#

Pre-Selection#

- Define custody requirements (AUM, asset types, jurisdictions)

- Determine qualified custodian necessity

- Budget allocation for custody fees

- Insurance requirements identification

- Regulatory compliance needs

Provider Evaluation#

- Security certifications (SOC 2, ISO 27001)

- Insurance coverage verification

- Regulatory licenses confirmation

- Financial stability review

- Customer references

- Service level agreements review

- Fee structure analysis

- Asset support confirmation

Technical Assessment#

- Architecture review (cold/hot ratio)

- Key management system evaluation

- Multi-sig capabilities

- API documentation review

- Integration complexity assessment

- Disaster recovery procedures

- Business continuity plans

- Incident response protocols

Legal Review#

- Master custody agreement

- Liability terms

- Termination clauses

- Asset recovery procedures

- Dispute resolution

- Governing law and jurisdiction

- Regulatory compliance terms

Ongoing Monitoring#

- Quarterly audit report review

- Annual insurance verification

- Regulatory status monitoring

- Financial health checks

- Security incident disclosures

- Service quality metrics

Future of Custody#

Emerging Technologies#

Threshold Signatures:

- No single complete private key

- Distributed key generation

- More secure than traditional multi-sig

Hardware Enclaves:

- Secure computation environments

- Confidential computing

- Trusted execution environments

Quantum-Resistant Cryptography:

- Post-quantum signature schemes

- Future-proofing against quantum computers

- Migration strategies

Institutional Adoption Drivers#

2025-2027 Trends:

- More banks entering custody market

- Standardized custody protocols

- Interoperable custody solutions

- Regulatory clarity increasing

- Insurance capacity expanding

Market Growth:

- Digital asset custody AUM expected to reach $10T+ by 2030

- Traditional custodians launching digital services

- Tokenization driving institutional custody demand

Frequently Asked Questions#

Is self-custody safe for enterprises?#

Self-custody can be safe with proper infrastructure (HSMs, multi-sig, procedures), but it requires significant technical expertise and operational commitment. Most enterprises without dedicated security teams should use qualified third-party custodians.

What's the typical cost of third-party custody?#

Annual fees range from 0.5% to 2% of assets under management, plus setup fees ($10K-$500K) and transaction fees ($10-$200 per transaction). Larger AUM typically negotiates lower percentage fees.

Can custody be moved to a different provider?#

Yes, but it requires careful planning. The migration involves:

- Setting up new custodian account

- Coordinating transfer timing

- Updating platform integrations

- Notifying investors

- Completing transfer (typically 1-5 business days)

What happens if a custodian goes bankrupt?#

If the custodian properly segregated client assets, they are protected from bankruptcy proceedings. Qualified custodians must maintain segregation. However, recovery can still take time, highlighting the importance of custodian selection.

Is insurance enough protection?#

Insurance is essential but not sufficient. It covers specific risks but has exclusions, deductibles, and claim processes. Strong security practices remain the primary defense.

What's better: multi-sig or MPC?#

Both have merits:

- Multi-sig: More transparent, simpler, proven track record

- MPC: Better privacy, lower fees, more flexible

For most enterprises, multi-sig is currently more mature and easier to audit.

Related Resources#

Enterprise Tokenization Guides#

- Best Tokenization Platforms 2025: Enterprise Guide — Complete platform comparison

- Regulatory Landscape 2025 — Global compliance guide

- ROI & Financial Modeling — Enterprise decision framework

- Why Tokenization Platforms Fail — Case studies and lessons

Security & Architecture#

- Platform Architecture Deep Dive — Technical infrastructure

- Security Guide for Investors — Investor perspective

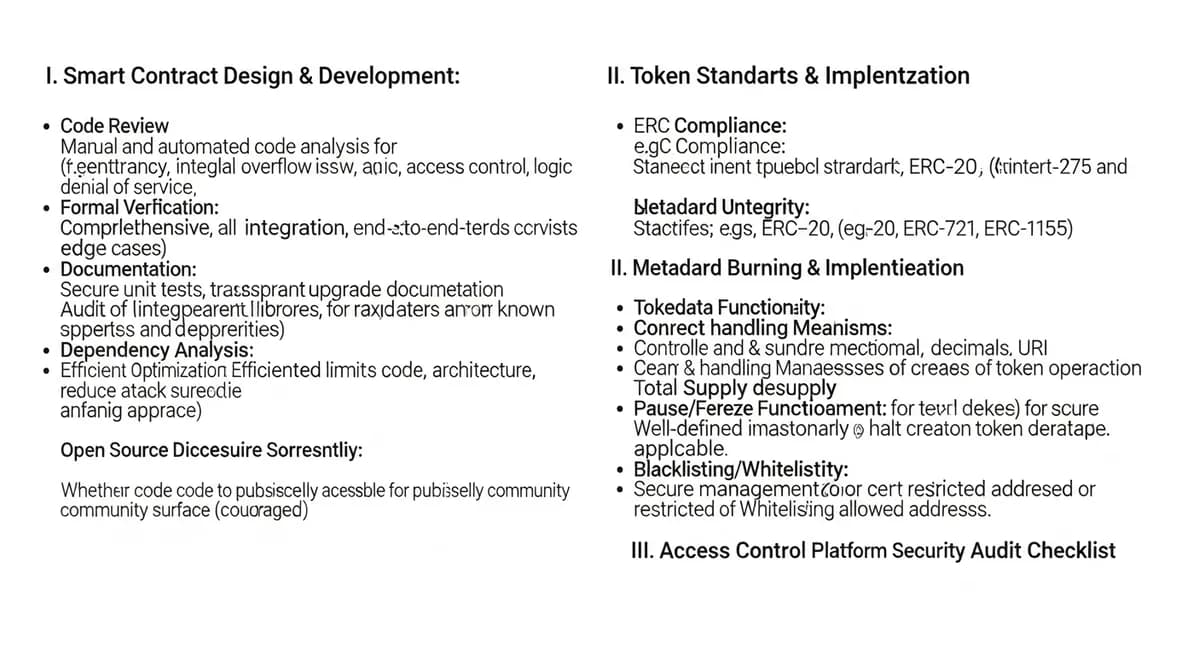

- Smart Contract Audit Checklist — Smart contract security

Platform Selection#

- Platform Comparison 2025 — Feature comparison matrix

- How to Choose: 15 Factors — Decision framework

- Enterprise Requirements — What enterprises need

Next Steps#

Custody is not an afterthought—it's the foundation of any secure tokenization platform. When evaluating platforms:

- Assess custody model against your security requirements

- Verify regulatory compliance for your target markets

- Review insurance coverage and claim history

- Evaluate operational complexity against your team's capabilities

Ready to implement bank-grade custody?

Schedule Security Consultation →

This guide is for informational purposes only. Custody requirements vary by jurisdiction and use case. Consult qualified legal and security professionals for your specific needs.