Public vs Private Blockchain for Asset Tokenization: 2025 Enterprise Guide

Enterprise decision guide: This article compares blockchain architectures for tokenization. For comprehensive technical guidance, see Blockchain Security & Token Technology: 2025 Reference Guide.

Choosing between public and private blockchain is one of the most consequential decisions in any tokenization project. The wrong choice can mean millions in unnecessary costs, security vulnerabilities, or regulatory non-compliance.

This guide provides a data-driven comparison to help enterprises make the right architectural decision.

For foundational understanding, see our Ultimate Guide to Tokenization and RWA. Learn about legal structures in our Tokenization Legal Structure guide.

Quick Comparison Matrix#

| Factor | Public Blockchain | Private Blockchain | Winner |

|---|---|---|---|

| Decentralization | Full | Partial/None | Public |

| Transaction Cost | $0.50-$50+ | $0.01-$0.10 | Private |

| Transaction Speed | 12-30 seconds | ~2 seconds | Private |

| Throughput (TPS) | 15-100 | 1,000-10,000+ | Private |

| Security Model | Cryptoeconomic | Permissioned | Depends |

| Privacy | Pseudonymous | Full control | Private |

| Regulatory Clarity | Evolving | Clear | Private |

| Liquidity Access | Global | Limited | Public |

| Interoperability | High | Low | Public |

| Control | None | Full | Private |

Understanding Blockchain Architectures#

What is a Public Blockchain?#

A public blockchain is a permissionless, decentralized network where anyone can:

- Participate as a validator/miner

- Read all transaction data

- Write transactions (with gas fees)

- Deploy smart contracts

Examples: Ethereum, Polygon, Avalanche, Solana, Base, Arbitrum

Characteristics:

- No central authority

- Consensus via economic incentives (PoW/PoS)

- Transparent, auditable transactions

- Global, 24/7 operation

- Native token for gas fees

What is a Private Blockchain?#

A private blockchain is a permissioned network where:

- Participation requires authorization

- Validators are known, trusted entities

- Access controlled by network operators

- Rules defined by consortium/operator

Examples: Hyperledger Fabric, R3 Corda, Quorum, ConsenSys Besu (private mode)

Characteristics:

- Centralized governance

- Consensus via voting/authority

- Selective data visibility

- Controlled participant list

- No native cryptocurrency required

Consortium Blockchain (Hybrid)#

A consortium blockchain sits between public and private:

- Multiple organizations share control

- Permissioned but not single-entity controlled

- Semi-decentralized governance

Examples: IBM Food Trust, Marco Polo Network, we.trade

Security Comparison#

Public Blockchain Security#

Strengths:

| Security Factor | Public Blockchain Advantage |

|---|---|

| Attack Resistance | 51% attacks require billions in hardware/stake |

| Immutability | Thousands of nodes prevent tampering |

| Censorship Resistance | No single entity can block transactions |

| Audit Trail | Permanent, public record |

| Battle Tested | Years of production, billions secured |

Weaknesses:

- Smart contract vulnerabilities (user responsibility)

- Front-running possible

- Transaction data publicly visible

- No recourse for lost keys

Security Model: Economic—attacking the network costs more than potential gain.

Private Blockchain Security#

Strengths:

| Security Factor | Private Blockchain Advantage |

|---|---|

| Access Control | Only authorized parties participate |

| Data Privacy | Transactions hidden from public |

| Regulatory Compliance | Full control over data retention |

| Key Recovery | Enterprise key management possible |

| Performance | Faster consensus, fewer attack surfaces |

Weaknesses:

- Single point of failure possible

- Insider attack risk

- Smaller validator set = easier collusion

- Depends on operator trustworthiness

- Less battle-tested

Security Model: Trust—participants are vetted and accountable.

Security Winner#

| Scenario | Winner | Reason |

|---|---|---|

| High-value public assets | Public | Battle-tested, maximum decentralization |

| Confidential transactions | Private | Data privacy control |

| Regulated financial products | Private | Compliance requirements |

| Global retail access | Public | No gatekeepers |

| Consortium of known parties | Private/Hybrid | Efficiency without full trust |

Cost Comparison#

Public Blockchain Costs#

Transaction Costs (as of 2025):

| Network | Avg Transaction Cost | Token Transfer | Smart Contract Call |

|---|---|---|---|

| Ethereum L1 | $2-$50 | $1-$5 | $5-$100+ |

| Polygon | $0.01-$0.10 | $0.005 | $0.02-$0.50 |

| Arbitrum | $0.10-$0.50 | $0.05 | $0.20-$2 |

| Base | $0.05-$0.20 | $0.02 | $0.10-$1 |

| Avalanche | $0.10-$1 | $0.05 | $0.30-$5 |

| Solana | $0.00025 | $0.0001 | $0.001-$0.01 |

Infrastructure Costs:

- Node operation: $500-$5,000/month (optional)

- RPC services: $0-$2,000/month

- Development: Standard tooling (free to $$$)

Private Blockchain Costs#

Infrastructure Costs:

| Component | Annual Cost |

|---|---|

| Validator nodes (3-7) | $50,000-$200,000 |

| Cloud infrastructure | $30,000-$100,000 |

| Maintenance & operations | $100,000-$300,000 |

| Security & audits | $50,000-$150,000 |

| Total Year 1 | $230,000-$750,000 |

Transaction Costs:

- Near-zero marginal cost per transaction

- Fixed infrastructure costs regardless of volume

Cost Winner by Volume#

| Annual Transactions | Winner | Break-Even Analysis |

|---|---|---|

| Under 100K | Public (L2) | Private infra cost > gas fees |

| 100K-1M | Depends | Calculate based on tx type |

| 1M-10M | Private | Gas fees exceed infra costs |

| >10M | Private | Clear private advantage |

Cost Optimization: Layer 2 solutions dramatically reduce public blockchain costs. See our Layer 1 vs Layer 2 for Security Tokens guide for detailed comparison.

Scalability Comparison#

Throughput Metrics#

| Blockchain | Transactions Per Second (TPS) | Finality Time |

|---|---|---|

| Ethereum L1 | 15-30 | 12-15 minutes |

| Polygon | 65-7,000 | 2-3 seconds |

| Arbitrum | 40,000+ | ~1 week (L1 finality) |

| Solana | 65,000+ | ~1 second |

| Hyperledger Fabric | 3,500-20,000 | ~2 seconds |

| R3 Corda | 1,700+ | Immediate |

| Quorum | 1,000+ | ~2 seconds |

Scalability for Tokenization#

Public Blockchain Considerations:

- Token transfers: 100-500 TPS on L2s (sufficient for most)

- Complex compliance checks: 20-100 TPS

- Batch operations: Can aggregate multiple transfers

Private Blockchain Considerations:

- Near-unlimited scale (add nodes)

- Consistent performance under load

- No congestion from external traffic

Scalability Winner#

| Use Case | Winner | Reason |

|---|---|---|

| Retail trading (millions of txs) | Private | Consistent throughput |

| Institutional transfers | Public (L2) | Sufficient TPS, better liquidity |

| High-frequency trading | Private | Sub-second finality |

| Periodic distributions | Either | Low volume, either works |

Regulatory Compliance Comparison#

Public Blockchain Compliance#

Challenges:

- Pseudonymous addresses complicate KYC

- Data immutability conflicts with GDPR "right to erasure"

- Cross-border data transfer concerns

- Uncertain regulatory treatment in some jurisdictions

Solutions:

- ERC-3643 standard for compliant security tokens

- Off-chain identity registries

- Encryption of sensitive data

- Compliance middleware (Chainalysis, Elliptic)

Regulatory Status:

- SEC: Securities tokens must comply with securities laws regardless of blockchain

- EU MiCA: Clear framework emerging for crypto-assets

- GCC: Progressive frameworks (VARA, SAMA) accommodating public chains

Private Blockchain Compliance#

Advantages:

- Full control over participant identity

- Data residency control (deploy in specific regions)

- Easy compliance with data protection laws

- Clear audit trails for regulators

- Can implement "right to erasure" via key deletion

Challenges:

- Must still comply with securities laws

- Requires own compliance infrastructure

- May need multiple deployments for jurisdictions

Compliance Winner#

| Requirement | Winner | Reason |

|---|---|---|

| KYC/AML enforcement | Private | Built-in identity control |

| GDPR compliance | Private | Data deletion possible |

| Global securities offering | Tie | Both require Reg D/S compliance |

| Cross-border transfers | Public | Interoperable by default |

| Regulatory reporting | Private | Full data access |

For detailed compliance guidance, see our Tokenization Regulation, Tax & Compliance Guide.

Liquidity & Interoperability#

Public Blockchain Liquidity#

Advantages:

- Access to $100B+ DeFi liquidity

- 24/7 global markets

- Cross-platform token movement

- DEX listing possibilities

- Composability with other protocols

Liquidity Sources:

- Centralized exchanges (Coinbase, Kraken)

- Decentralized exchanges (Uniswap, Curve)

- OTC desks

- Lending protocols

- Secondary markets

Private Blockchain Liquidity#

Challenges:

- Siloed from public markets

- Requires custom exchange integration

- Limited secondary market options

- No DeFi composability

Solutions:

- Bridges to public chains

- Integration with licensed exchanges

- OTC matching engines

- Consortium market-making

Liquidity Winner#

| Factor | Winner | Impact |

|---|---|---|

| Secondary trading | Public | Critical for investor exit |

| Price discovery | Public | More market participants |

| Institutional trading | Tie | Both support OTC |

| DeFi integration | Public | Only option for DeFi |

Privacy Considerations#

Public Blockchain Privacy#

Default State: Pseudonymous—addresses visible, identity not directly linked

Privacy Solutions:

- Zero-knowledge proofs (zkSNARKs, zkSTARKs)

- Privacy-focused L2s (Aztec, zkSync)

- Off-chain data storage

- Encrypted payloads

What's Visible:

- All token transfers

- Contract interactions

- Wallet balances

- Transaction history

Private Blockchain Privacy#

Default State: Full control over data visibility

Privacy Options:

- Transaction-level privacy

- Channel-based isolation (Hyperledger)

- Role-based data access

- Selective disclosure

What's Hidden:

- Everything (from unauthorized parties)

- Can be selectively revealed to regulators

Privacy Winner#

| Requirement | Winner | Reason |

|---|---|---|

| Transaction privacy | Private | Default hidden |

| Competitive intelligence | Private | Competitors can't see |

| Regulatory transparency | Tie | Both can provide access |

| Public verifiability | Public | Anyone can verify |

Implementation Complexity#

Public Blockchain Implementation#

Development:

- Standard tools (Solidity, Hardhat, Foundry)

- Rich ecosystem of libraries

- Extensive documentation

- Large developer community

Timeline:

- MVP: 2-4 months

- Production: 4-8 months

- Total cost: $150K-$500K

Ongoing:

- No infrastructure to maintain (use RPC providers)

- Smart contract upgrades via proxy patterns

- Monitoring via public explorers

Private Blockchain Implementation#

Development:

- Platform-specific languages (Fabric: Go/Java, Corda: Kotlin)

- Smaller developer pool

- Enterprise training required

- Custom tooling often needed

Timeline:

- MVP: 4-8 months

- Production: 8-18 months

- Total cost: $500K-$2M+

Ongoing:

- Infrastructure management

- Node updates and patching

- Performance monitoring

- Disaster recovery

Implementation Winner#

| Factor | Winner | Reason |

|---|---|---|

| Time to market | Public | Faster development |

| Developer availability | Public | Larger talent pool |

| Customization | Private | Full control |

| Long-term TCO | Depends | Volume-dependent |

Decision Framework#

Choose Public Blockchain When:#

✅ Global retail investor access needed ✅ Secondary market liquidity important ✅ DeFi integration desired ✅ Fastest time to market required ✅ Budget under $500K ✅ Transaction volume under 1M/year ✅ Interoperability with other projects needed ✅ Decentralization is a feature, not a bug

Choose Private Blockchain When:#

✅ Full data privacy required ✅ Regulatory environment demands control ✅ Transaction volume exceeds 1M/year ✅ Sub-second finality critical ✅ Known, trusted participants only ✅ Enterprise integration (SAP, Oracle) needed ✅ Geographic data residency mandated ✅ Custom consensus requirements

Choose Hybrid (Consortium) When:#

✅ Multiple institutions collaborating ✅ Need private execution + public settlement ✅ Want best of both worlds ✅ Building industry infrastructure ✅ Regulatory sandbox participation

Hybrid Architecture: Best of Both Worlds#

How Hybrid Works#

Private Chain (Execution Layer)

│

├── Transaction processing

├── Compliance checks

├── Identity management

│

▼

Bridge / Settlement Layer

│

├── Proof aggregation

├── State commitments

│

▼

Public Chain (Settlement Layer)

│

├── Final settlement

├── Proof verification

└── Global interoperability

Hybrid Benefits#

- Privacy: Sensitive data on private chain

- Liquidity: Access public DeFi markets

- Compliance: Full control over execution

- Security: Public chain anchoring

- Performance: Private chain speed

Hybrid Examples#

| Project | Private Layer | Public Layer | Use Case |

|---|---|---|---|

| JPM Coin | Quorum | Ethereum | Institutional settlement |

| Canton | Canton Network | Ethereum | Financial institutions |

| Fnality | Private | Multiple | Cross-border settlement |

Real-World Case Studies#

Case 1: BlackRock BUIDL Fund#

Choice: Public blockchain (Ethereum)

Rationale:

- Global investor access

- Secondary market liquidity

- DeFi integration potential

- Signal to crypto-native investors

Outcome: $500M+ AUM, strong market reception

Case 2: Singapore Exchange (SGX)#

Choice: Private blockchain (consortium)

Rationale:

- Regulatory requirements

- Known institutional participants

- High transaction volume

- Integration with existing systems

Outcome: Successful fixed income platform

Case 3: Paxos Gold (PAXG)#

Choice: Public blockchain (Ethereum)

Rationale:

- Retail accessibility

- Global 24/7 trading

- DeFi collateral use

- Transparency for gold backing

Outcome: $500M+ gold tokenized

Platform Support Matrix#

| Platform | Public Support | Private Support | Hybrid |

|---|---|---|---|

| Pedex | ✅ Ethereum, Polygon | ✅ Enterprise | ✅ |

| Securitize | ✅ Multiple L1/L2 | ❌ | ❌ |

| Polymath | ✅ Polymesh | ✅ Private mode | ✅ |

| Tokeny | ✅ Ethereum | ✅ Enterprise | ✅ |

| R3 Corda | ❌ | ✅ Native | Partial |

For platform comparison, see Best Tokenization Platforms 2025: Enterprise Comparison Guide.

Migration Considerations#

Public → Private Migration#

When to Consider:

- Regulatory pressure

- Scale requirements

- Privacy needs

- Cost optimization at scale

Process:

- Deploy private infrastructure

- Snapshot token state

- Issue new tokens on private chain

- Coordinate holder migration

- Deprecate public tokens

Cost: $300K-$1M+

Private → Public Migration#

When to Consider:

- Need retail access

- Want DeFi integration

- Liquidity requirements

- Reduce infrastructure costs

Process:

- Deploy public contracts

- Bridge implementation

- Migrate holder identities

- Enable public trading

- Maintain compliance layer

Cost: $200K-$500K

Frequently Asked Questions#

Q: Can I start private and move public later? A: Yes, but plan for it. Design contracts with migration in mind. Budget $200K-$500K for migration.

Q: Is public blockchain safe for securities? A: Yes, with proper implementation. Standards like ERC-3643 provide compliant security token frameworks.

Q: What about transaction privacy on public chains? A: Use zero-knowledge proofs, private L2s, or hybrid architecture. Full privacy possible with additional complexity.

Q: Which is better for regulatory compliance? A: Private offers more control, but public with proper KYC/AML can satisfy most regulators. See our compliance guide.

Q: What's the minimum viable budget? A: Public (L2): $100K-$300K. Private: $500K-$1M. Hybrid: $400K-$800K.

Q: Can the same token exist on both? A: Yes, via bridges. The token is "locked" on one chain and "minted" on another.

Conclusion#

Public blockchain wins for: accessibility, liquidity, speed-to-market, and interoperability.

Private blockchain wins for: privacy, control, scale, and regulatory clarity.

Hybrid wins for: enterprises wanting both liquidity and control.

Most tokenization projects in 2025 are choosing public Layer 2 solutions (Polygon, Arbitrum, Base) as they offer the best balance: low costs, sufficient privacy, regulatory compliance, and global liquidity access.

For high-value institutional use cases with strict privacy requirements, private or hybrid remains the optimal choice.

Related Resources#

Technical Guides:

- Blockchain Security & Token Technology: 2025 Reference Guide - Complete technical reference

- ERC-3643 vs ERC-1400: Security Token Standards - Token standard comparison

- Layer 1 vs Layer 2 for Security Tokens - L1/L2 comparison

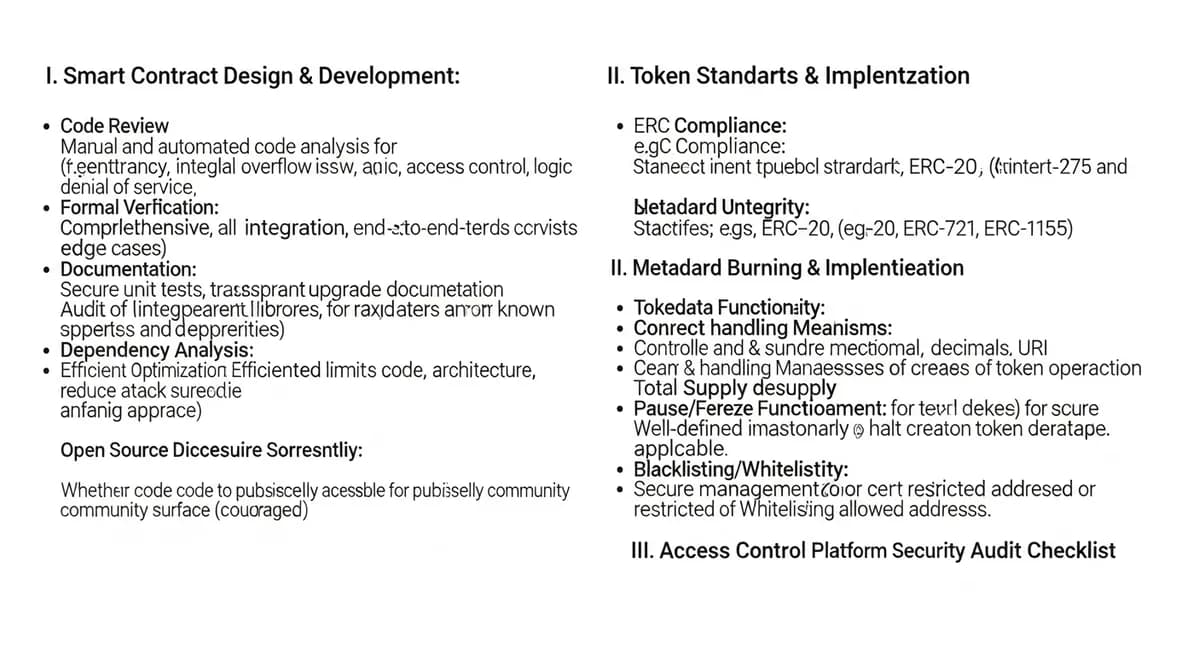

- Smart Contract Security Audit Checklist - Security requirements

Platform Selection:

- Best Tokenization Platforms 2025 - Enterprise platform guide

- How to Choose a Tokenization Platform: 15 Factors - Selection framework

Compliance:

- Tokenization Regulation & Compliance Guide - Regulatory framework

- Tokenization Platform Security: Investors Guide - Security for investors

Learning Center:

- Ultimate Guide to Tokenization and RWA - Comprehensive foundation

Need help choosing the right blockchain architecture? Contact our technical team for a personalized assessment of your tokenization requirements.

Disclaimer: This guide is for informational purposes only. Blockchain technology and regulations evolve rapidly. Consult technical and legal advisors for specific implementation decisions.