Blockchain Security & Token Technology: 2025 Reference Guide

Understanding blockchain technology and security is essential for anyone involved in tokenization. This comprehensive guide covers token standards, smart contract security, blockchain networks, and security best practices for tokenized assets.

For foundational understanding, see our Ultimate Guide to Tokenization and RWA. Learn about legal structures in our Tokenization Legal Structure guide.

Table of Contents#

- Blockchain Fundamentals

- Token Standards Comparison

- Smart Contract Security

- Security Best Practices

- Platform Security

- Cross-Border Settlement

- Network Selection

- Audit Requirements

- Common Questions

Blockchain Fundamentals#

What is Blockchain?#

Blockchain is a distributed ledger technology that maintains a continuously growing list of records (blocks) linked and secured using cryptography. Key features:

- Decentralization: No single point of control

- Immutability: Records cannot be altered retroactively

- Transparency: All transactions are visible

- Security: Cryptographic hashing ensures integrity

How Tokenization Works#

- Asset Valuation: Underlying asset is valued

- Token Creation: Smart contract creates tokens representing ownership

- Distribution: Tokens are distributed to investors

- Trading: Tokens trade on secondary markets

- Distributions: Income automatically distributed via smart contracts

Token Standards Comparison#

ERC-3643 (T-REX Standard)#

Overview: Industry standard for security tokens, developed by Tokeny Solutions.

Key Features:

- Built-in compliance (KYC/AML)

- Transfer restrictions

- Identity verification

- Regulatory compliance

Use Cases: Security tokens, regulated assets

Pros:

- Strong compliance features

- Industry standard

- Well-audited

Cons:

- More complex than ERC-20

- Higher gas costs

See ERC-3643 vs ERC-1400: Security Token Standards Comparison for detailed comparison.

ERC-1400 (Security Token Standard)#

Overview: Standard for security tokens with transfer restrictions.

Key Features:

- Transfer restrictions

- Document management

- Partitioning support

Use Cases: Security tokens, partitioned assets

Pros:

- Flexible partitioning

- Document management

Cons:

- Less compliance automation than ERC-3643

- More complex implementation

ERC-20 (Fungible Tokens)#

Overview: Standard for fungible tokens.

Key Features:

- Simple implementation

- Wide compatibility

- Low gas costs

Use Cases: Utility tokens, simple tokens

Pros:

- Simple and widely supported

- Low cost

Cons:

- No built-in compliance

- Not suitable for securities

ERC-1155 (Multi-Token Standard)#

Overview: Standard for multiple token types in single contract.

Key Features:

- Multiple token types

- Batch operations

- Gas efficient

Use Cases: NFTs, gaming, multi-asset tokens

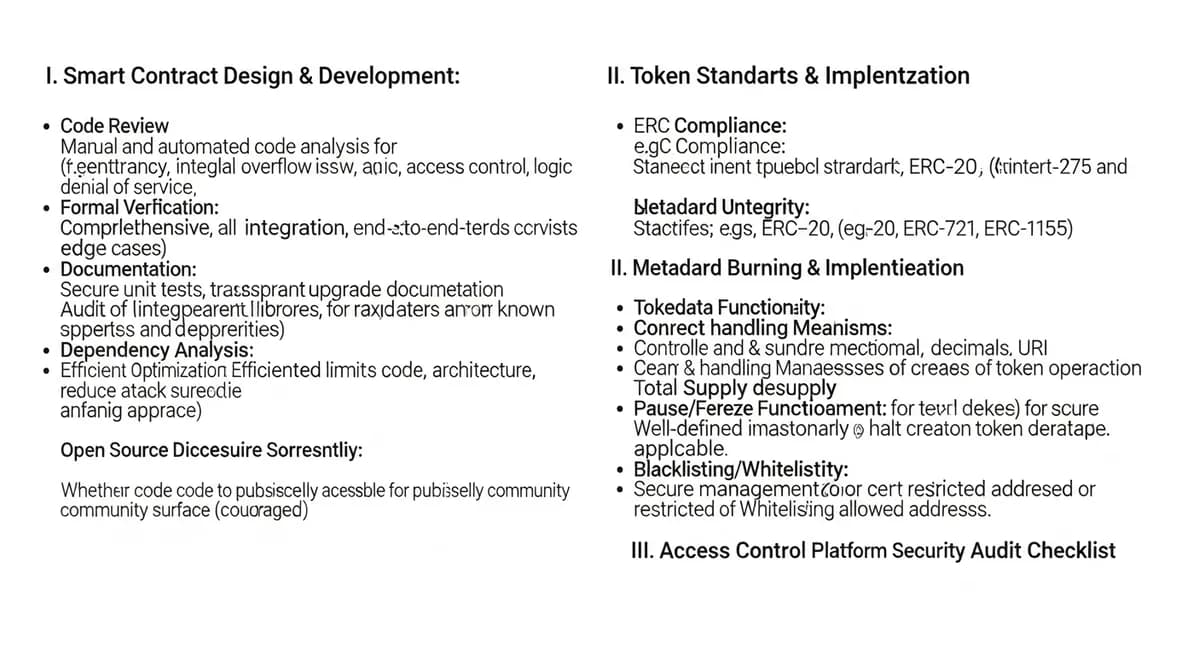

Smart Contract Security#

Security Risks#

1. Reentrancy Attacks

- Function calls back into contract before completion

- Can drain funds

- Mitigation: Use checks-effects-interactions pattern

2. Integer Overflow/Underflow

- Arithmetic operations exceed limits

- Mitigation: Use SafeMath library

3. Access Control Issues

- Unauthorized access to functions

- Mitigation: Proper role-based access control

4. Front-Running

- Miners/validators see transactions before execution

- Mitigation: Commit-reveal schemes

5. Logic Errors

- Incorrect business logic

- Mitigation: Comprehensive testing

Security Best Practices#

1. Code Audits

- Professional security audits

- Multiple audit rounds

- Public audit reports

2. Testing

- Unit tests

- Integration tests

- Formal verification

3. Access Control

- Multi-signature wallets

- Role-based permissions

- Time locks for critical functions

4. Upgradeability

- Proxy patterns for upgrades

- Governance mechanisms

- Emergency pause functions

See Smart Contract Security Audit Checklist for Tokenization for comprehensive checklist.

Security Best Practices#

Platform Security#

1. Custody Solutions

- Multi-signature wallets

- Hardware security modules (HSM)

- Cold storage for majority of assets

- Insurance coverage

2. Key Management

- Secure key generation

- Key rotation policies

- Backup and recovery procedures

- No single point of failure

3. Network Security

- DDoS protection

- Rate limiting

- Intrusion detection

- Regular security updates

4. Access Control

- Multi-factor authentication

- Role-based access control

- Regular access reviews

- Audit logs

See Blockchain Security: Best Practices for Asset Tokenization for detailed guidance.

Platform Security#

Security Architecture#

1. Infrastructure

- Cloud security (AWS, Azure, GCP)

- Network segmentation

- Firewall rules

- DDoS protection

2. Application Security

- Secure coding practices

- Regular security updates

- Penetration testing

- Bug bounty programs

3. Data Protection

- Encryption at rest and in transit

- Data backup and recovery

- Privacy compliance (GDPR, etc.)

4. Incident Response

- Security monitoring

- Incident response plan

- Regular drills

- Communication plan

See Tokenization Platform Security: What Investors Need to Know for investor-focused security information.

Cross-Border Settlement#

Challenges#

1. Regulatory Differences

- Varying compliance requirements

- Different KYC/AML rules

- Jurisdictional conflicts

2. Technical Challenges

- Network interoperability

- Cross-chain transfers

- Settlement finality

3. Operational Challenges

- Time zone differences

- Currency conversion

- Tax implications

Solutions#

1. Interoperability Protocols

- Cross-chain bridges

- Atomic swaps

- Interoperability standards

2. Regulatory Compliance

- Multi-jurisdictional compliance

- Automated KYC/AML

- Regulatory reporting

3. Settlement Mechanisms

- Atomic settlement

- Escrow services

- Smart contract automation

See Cross-Border Tokenized Settlement: Technology & Compliance for detailed information.

Network Selection#

Ethereum#

Pros:

- Largest ecosystem

- Strong security

- Wide tooling support

Cons:

- High gas costs

- Slower transactions

Polygon#

Pros:

- Low gas costs

- Fast transactions

- Ethereum compatibility

Cons:

- Smaller ecosystem

- Security trade-offs

Other Networks#

- Avalanche: Fast, low cost

- Solana: Very fast, low cost

- Base: Coinbase's L2

- Arbitrum: Ethereum L2

Layer 1 vs Layer 2 for Security Tokens#

Choosing between Layer 1 (Ethereum mainnet) and Layer 2 solutions (Polygon, Arbitrum, Base) significantly impacts costs and performance. L2 solutions offer 90%+ gas savings while inheriting Ethereum's security.

See Layer 1 vs Layer 2 for Security Tokens: Speed, Cost & Compliance Compared for detailed comparison.

Public vs Private Blockchain#

Enterprise tokenization projects must also choose between public blockchains (permissionless, global access) and private blockchains (controlled access, privacy).

See Public vs Private Blockchain for Asset Tokenization: 2025 Enterprise Guide for decision framework.

Audit Requirements#

Audit Types#

1. Code Audits

- Security vulnerabilities

- Logic errors

- Best practices

2. Economic Audits

- Tokenomics analysis

- Economic incentives

- Attack vectors

3. Compliance Audits

- Regulatory compliance

- KYC/AML procedures

- Reporting requirements

Audit Process#

- Preparation: Documentation, code review

- Audit: Automated and manual analysis

- Reporting: Findings and recommendations

- Remediation: Fix identified issues

- Re-audit: Verify fixes

See Smart Contract Security Audit Checklist for Tokenization for audit checklist.

Common Questions (FAQ)#

Which token standard should I use?#

ERC-3643 for security tokens with compliance needs. ERC-20 for simple tokens. ERC-1155 for multi-token scenarios.

How secure are smart contracts?#

Security depends on code quality, audits, and testing. Well-audited contracts from reputable developers are generally secure, but risks remain.

What blockchain network should I use?#

Ethereum for security and ecosystem. Polygon for cost efficiency. Consider your specific needs.

Do I need a security audit?#

Yes, for any production smart contract handling significant value. Audits identify vulnerabilities before deployment.

How do cross-border settlements work?#

Through interoperability protocols, cross-chain bridges, and compliance with multiple jurisdictions. See Cross-Border Tokenized Settlement.

Next Steps#

- Understand Standards: Review ERC-3643 vs ERC-1400 Comparison

- Choose Architecture: Compare Public vs Private Blockchain for your use case

- Select Scaling Solution: Evaluate Layer 1 vs Layer 2 for optimal costs

- Security Audit: Use Smart Contract Audit Checklist

- Best Practices: Follow Blockchain Security Best Practices

- Platform Security: Review Platform Security Guide

Ensure your tokenization is secure

Review our security framework and audit processes. We provide institutional-grade security, regular audits, and comprehensive protection for tokenized assets.

This guide is for informational purposes only. Always consult with security experts and conduct professional audits before deploying smart contracts.