Cross-Border Tokenized Settlement: Revolutionizing International Asset Transfers

Cross-border technology: This article covers settlement technology. For comprehensive blockchain security and technology guidance, see Blockchain Security & Token Technology: 2025 Reference Guide.

International asset transfers have traditionally been slow, expensive, and opaque. Cross-border tokenized settlement leverages blockchain to enable instant, transparent, and cost-effective global transactions.

For comprehensive context, see our Ultimate Guide to Tokenization and RWA. Learn finance-specific applications in our RWA in Banking guide.

The Problem with Traditional Settlement#

Current Challenges#

1. Speed Issues

- 3-5 business days for securities settlement

- 1-7 days for international wire transfers

- Settlement risk during transfer period

2. High Costs

- Correspondent banking fees (3-7%)

- Currency conversion charges

- Intermediary costs

- Swift message fees

3. Lack of Transparency

- Unclear fee structures

- Unknown transfer status

- Hidden FX markups

- Complex reconciliation

4. Limited Accessibility

- Banking hours restrictions

- Weekend/holiday delays

- Minimum transaction sizes

- Geographic limitations

How Tokenized Settlement Works#

Blockchain-Based Process#

Step 1: Asset Tokenization

- Real-world asset converted to digital token

- Ownership rights encoded in smart contract

- Compliance rules embedded

Step 2: On-Chain Transfer

- Buyer and seller connect via blockchain

- Smart contract executes transaction

- Atomic swap ensures simultaneous exchange

Step 3: Instant Settlement

- Transaction finalized in seconds/minutes

- Ownership transferred immediately

- All parties updated simultaneously

Key Technologies#

Smart Contracts

- Automated execution

- Conditional logic

- Multi-party coordination

Distributed Ledger

- Single source of truth

- Real-time updates

- Immutable records

Cryptographic Security

- Digital signatures

- Encryption

- Multi-signature requirements

Benefits of Tokenized Settlement#

1. Speed & Efficiency#

Real-Time Settlement

- Seconds to minutes vs. days

- 24/7/365 availability

- No banking hour restrictions

Operational Efficiency

- Automated reconciliation

- Reduced manual processes

- Lower error rates

2. Cost Reduction#

Direct Transactions

- Eliminate correspondent banks

- Remove intermediary fees

- Reduce processing costs

Lower FX Costs

- Transparent exchange rates

- Competitive pricing

- Reduced spreads

Estimated Savings: 70-90% reduction in total settlement costs

3. Transparency#

Real-Time Tracking

- Transaction status visibility

- Instant confirmations

- Clear audit trails

Fee Clarity

- All costs disclosed upfront

- No hidden charges

- Predictable pricing

4. Risk Mitigation#

Delivery vs. Payment (DvP)

- Simultaneous asset and payment transfer

- Eliminates settlement risk

- Protects both parties

Smart Contract Security

- Automated compliance checks

- Funds held in escrow

- Conditional release

Use Cases#

1. International Real Estate Transactions#

Traditional Process

- 60-90 days to close

- Multiple intermediaries

- High legal fees

- Currency risk

Tokenized Solution

- 24-48 hours to close

- Direct peer-to-peer

- Automated compliance

- Instant currency settlement

Example: Dubai → London property purchase

- Token represents property ownership

- Payment in stablecoins or tokenized fiat

- Smart contract handles title transfer

- Settlement in 2 hours vs. 2 months

2. Cross-Border Securities Trading#

Challenges

- T+2 settlement standard

- Multiple clearinghouses

- Currency conversion delays

- High custody costs

Tokenization Benefits

- Instant settlement (T+0)

- Direct registry updates

- Multi-currency support

- Lower custody fees

Example: US investor buying European stocks

- Tokenized stocks on blockchain

- Payment in digital USD

- Immediate ownership transfer

- 99% cost reduction

3. Supply Chain Finance#

Traditional

- Letter of credit process (weeks)

- Documentary collections

- High bank fees

- Limited transparency

Tokenized

- Smart contract escrow

- Automated release upon delivery proof

- Oracle-verified conditions

- Real-time payment

Example: International trade transaction

- Exporter ships goods

- IoT sensors confirm delivery

- Smart contract releases payment

- Settlement in minutes

4. Investment Fund Subscriptions#

Conventional Process

- Wire transfer (3-5 days)

- FX conversion fees

- Settlement delays

- Reconciliation issues

Token-Based Process

- Instant crypto/stablecoin payment

- Immediate fund token issuance

- Automated NAV calculation

- Real-time portfolio update

Technical Architecture#

Multi-Chain Infrastructure#

Layer 1 Blockchains

- Ethereum: Institutional-grade security

- Avalanche: Fast finality

- Polygon: Low-cost transactions

- Solana: High throughput

Cross-Chain Bridges

- Asset transfers between chains

- Unified liquidity pools

- Interoperability protocols

Stablecoin Integration#

USDC/USDT

- Dollar-pegged stability

- High liquidity

- Wide acceptance

CBDC Integration

- Central bank digital currencies

- Regulatory compliance

- Government backing

Oracle Networks#

Price Feeds

- Real-time exchange rates

- Asset valuations

- Market data

Data Verification

- Delivery confirmations

- Legal compliance

- Identity verification

Regulatory Compliance#

KYC/AML Integration#

Identity Verification

- On-chain KYC credentials

- Privacy-preserving proofs

- Reusable verification

Transaction Monitoring

- Automated suspicious activity detection

- Regulatory reporting

- Sanctions screening

Securities Regulations#

Compliance Tokens

- ERC-3643 with built-in rules

- Transfer restrictions

- Investor qualifications

Jurisdictional Adaptation

- Country-specific rules

- Regulator reporting

- Legal framework compatibility

Implementation Strategies#

For Financial Institutions#

Phase 1: Pilot Program

- Select use case (remittances, trade finance)

- Partner with blockchain platform

- Test with limited volume

Phase 2: Integration

- Connect core banking systems

- Implement smart contracts

- Train staff

Phase 3: Scale

- Expand to more products

- Increase transaction volume

- Onboard more partners

For Enterprises#

Assessment

- Identify cross-border pain points

- Calculate potential savings

- Evaluate blockchain solutions

Pilot

- Start with one supply chain partner

- Tokenize one asset class

- Measure results

Expansion

- Roll out to more partners

- Add asset classes

- Integrate with ERP systems

Real-World Examples#

1. HSBC-IBM Trade Finance#

- Tokenized letter of credit

- 90% reduction in processing time

- $20M+ in cost savings

- Now processing $250B annually

2. JPMorgan Onyx#

- Blockchain-based wholesale payments

- $300B+ daily transactions

- 24/7 settlement capability

- Integrated with traditional banking

3. Broadridge DLR#

- Securities settlement on blockchain

- T+0 settlement achieved

- 90% cost reduction

- Used by major brokers

Challenges and Solutions#

Challenge 1: Regulatory Uncertainty#

Solution

- Work with progressive jurisdictions

- Engage regulators early

- Join industry standards bodies

- Maintain compliance flexibility

Challenge 2: Technology Integration#

Solution

- Use API-based connections

- Implement gradual migration

- Maintain legacy system compatibility

- Invest in staff training

Challenge 3: Liquidity#

Solution

- Partner with market makers

- Create liquidity pools

- Offer competitive spreads

- Build network effects

Challenge 4: Adoption#

Solution

- Start with motivated partners

- Demonstrate clear ROI

- Provide excellent support

- Build success stories

Future Trends#

CBDC Integration#

Central bank digital currencies will:

- Provide stable settlement currency

- Enable programmable money

- Reduce counterparty risk

- Facilitate instant cross-border payments

AI-Powered Optimization#

Artificial intelligence for:

- Route optimization

- FX timing

- Risk assessment

- Fraud detection

Universal Digital Payment Rails#

Emerging infrastructure:

- Interoperable blockchains

- Standardized protocols

- Global liquidity networks

- Instant settlement worldwide

Cost-Benefit Analysis#

Traditional Settlement#

Costs

- Correspondent banking: 3-7%

- FX spreads: 1-3%

- SWIFT fees: $25-50

- Processing: $100-500

- Total: 5-10% + fixed fees

Time

- 3-7 business days

- Business hours only

- Settlement risk period

Tokenized Settlement#

Costs

- Blockchain fees: 0.1-0.5%

- Platform fees: 0.2-1%

- FX (if needed): 0.1-0.5%

- Total: 0.4-2%

Time

- Minutes to hours

- 24/7 availability

- Instant finality

ROI: 70-90% cost savings, 95%+ time reduction

Getting Started#

For Investors#

- Open account with tokenization platform

- Complete KYC verification

- Fund with crypto/stablecoins

- Execute cross-border transactions

- Track settlement in real-time

For Institutions#

- Assess current settlement costs

- Identify high-value use cases

- Select blockchain infrastructure partner

- Pilot with trusted counterparties

- Scale based on results

Conclusion#

Cross-border tokenized settlement represents one of blockchain's most compelling use cases. By eliminating intermediaries, reducing costs by up to 90%, and enabling instant 24/7 settlement, tokenization solves long-standing problems in international finance.

As more institutions adopt blockchain-based settlement and CBDCs launch worldwide, tokenized cross-border transactions will become the new standard for global commerce.

The question isn't whether to adopt tokenized settlement—it's how quickly you can implement it to stay competitive in the digital economy.

Learn More: Blockchain Security & Token Technology#

Comprehensive Technology Guide:

→ Blockchain Security & Token Technology: 2025 Reference Guide - Complete technical reference

Related Technology Articles:

- ERC-3643 vs ERC-1400: Security Token Standards Explained - Standards comparison

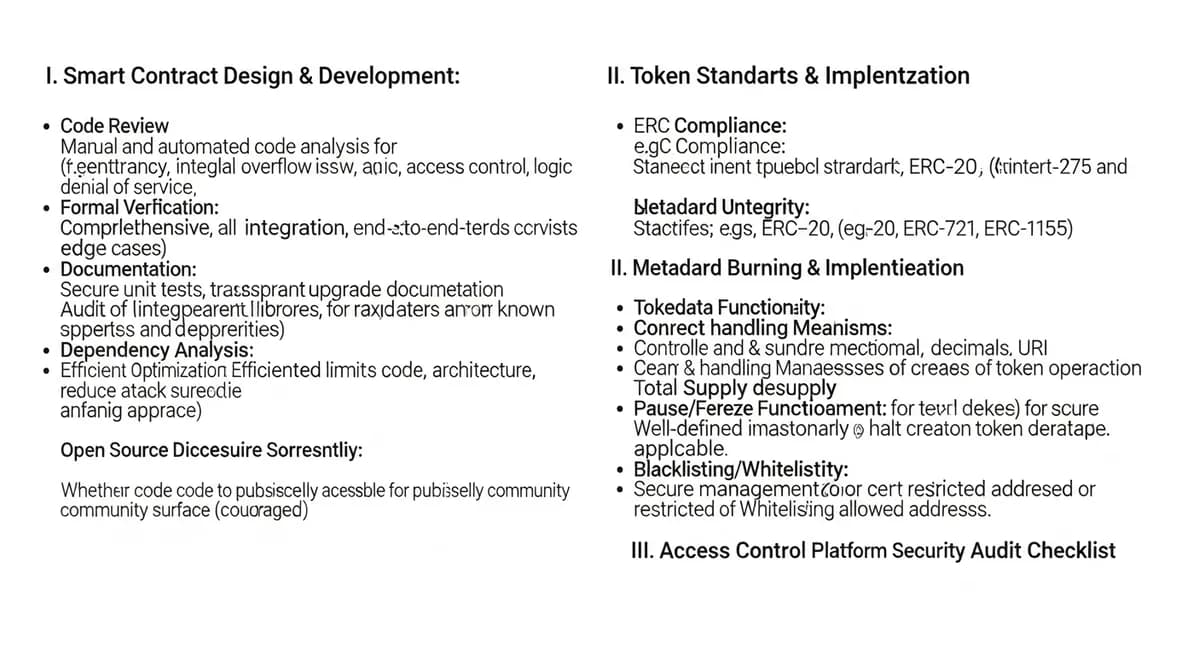

- Smart Contract Security Audit Checklist for Tokenization - Security audit framework

- Blockchain Security: Best Practices for Asset Tokenization - Security best practices

- Tokenization Platform Security: What Investors Need to Know - Platform security

Enterprise:

- Best Tokenization Platforms 2025: Enterprise Comparison Guide - Platform technical comparison

Next Steps:

- Contact Pedex - Transform your international operations

- Schedule a Consultation - Get settlement infrastructure guidance

Ready for instant cross-border settlement? Pedex provides comprehensive tokenization infrastructure for global transactions. Contact us to learn how we can transform your international operations.