The Future of Asset Tokenization: Trends to Watch in 2024

Technology trends: This article covers future trends. For comprehensive blockchain security and technology guidance, see Blockchain Security & Token Technology: 2025 Reference Guide.

Asset tokenization is evolving rapidly. Here are the key trends that will shape the industry in 2024 and beyond.

For comprehensive context on tokenization, see our Ultimate Guide to Tokenization and RWA.

1. Institutional Adoption Accelerates#

Banks Enter the Space#

Major financial institutions are launching tokenization platforms:

- JPMorgan's Onyx platform

- Goldman Sachs' digital assets division

- HSBC's tokenization offerings

Impact#

- Increased legitimacy

- Better liquidity

- More sophisticated products

- Regulatory clarity

2. Regulatory Frameworks Mature#

Global Coordination#

Regulators worldwide are developing comprehensive frameworks:

- MiCA in Europe: Harmonized crypto regulations

- SEC Clarity in US: Updated guidance on digital assets

- Asian Leadership: Singapore and Hong Kong leading innovation

What This Means#

- More investor protection

- Clearer compliance requirements

- Easier cross-border transactions

- Mainstream adoption

3. New Asset Classes Go On-Chain#

Beyond Real Estate#

Tokenization expanding to:

- Carbon Credits: Environmental assets

- Intellectual Property: Patents, copyrights

- Royalties: Music, film, streaming rights

- Infrastructure: Roads, bridges, utilities

- Equipment: Aircraft, ships, machinery

4. Technology Improvements#

Interoperability#

Cross-chain solutions enabling:

- Assets on multiple blockchains

- Seamless transfers between chains

- Unified liquidity pools

- Better user experience

Layer 2 Solutions#

Faster and cheaper transactions:

- Polygon, Arbitrum, Optimism

- Lower gas fees

- Higher throughput

- Better scalability

Privacy Enhancements#

Zero-knowledge proofs offering:

- Compliant privacy

- Confidential transactions

- Protected business data

- Regulatory compliance

5. DeFi Integration#

Tokenized Assets as Collateral#

Use real-world assets in DeFi:

- Lending protocols

- Borrowing against tokens

- Yield farming

- Liquidity provision

Hybrid Products#

Combining TradFi and DeFi:

- Regulated yield products

- Automated market makers

- Compliant liquidity pools

- Smart treasury management

6. Fractional Ownership Mainstream#

Lower Minimums#

Platforms offering:

- $10-100 minimum investments

- Micro-investing in premium assets

- Portfolio diversification for everyone

- Gamified investment experiences

7. Secondary Markets Emerge#

Trading Infrastructure#

Development of:

- Decentralized exchanges for security tokens

- Order book matching

- Market makers

- Trading APIs

Liquidity Solutions#

- Automated liquidity pools

- Cross-platform trading

- Institutional market makers

- Enhanced price discovery

8. AI and Tokenization#

Smart Contract Auditing#

AI-powered tools for:

- Automatic vulnerability detection

- Code optimization

- Risk assessment

- Continuous monitoring

Investment Analysis#

AI assisting with:

- Asset valuation

- Risk scoring

- Portfolio optimization

- Market predictions

9. Sustainability Focus#

Green Assets#

Growing demand for:

- Renewable energy projects

- Carbon credit tokens

- Sustainable real estate

- ESG-compliant investments

Impact Measurement#

Blockchain tracking:

- Environmental impact

- Social outcomes

- Governance metrics

- Transparent reporting

10. User Experience Revolution#

Simplified Onboarding#

- One-click KYC

- Social login integration

- Mobile-first platforms

- Gamified experiences

Better Interfaces#

- Intuitive dashboards

- Real-time analytics

- Educational tools

- Seamless transactions

Market Predictions#

By End of 2024#

- $5 trillion in tokenized assets (up from $2T)

- 100+ countries with clear regulations

- Major asset classes on blockchain

- Retail adoption accelerates

By 2030#

- $16 trillion in tokenized assets

- Most real estate transactions involve tokens

- Standard investment option

- Integration with traditional finance complete

Opportunities for Investors#

Early Advantage#

Getting in now offers:

- Access to emerging markets

- Better pricing

- First-mover advantages

- Learning curve benefits

New Products#

Expect innovative offerings:

- Tokenized ETFs

- Hybrid securities

- Programmable assets

- Automated portfolios

Challenges Ahead#

Technical#

- Scalability issues

- Interoperability gaps

- User experience friction

- Security concerns

Regulatory#

- Jurisdiction differences

- Compliance complexity

- Tax treatment uncertainty

- Cross-border challenges

Market#

- Liquidity constraints

- Price discovery

- Adoption speed

- Education needs

How to Prepare#

For Investors#

- Educate yourself on blockchain and tokenization

- Start small with reputable platforms

- Stay informed on regulatory changes

- Diversify your portfolio

- Think long-term

For Issuers#

- Understand regulations in your jurisdiction

- Choose the right tokenization standard

- Partner with experienced platforms

- Focus on investor protection

- Build for the long term

Conclusion#

2024 marks a pivotal year for asset tokenization. As technology matures, regulations clarify, and institutions adopt, we're moving toward a future where any asset can be tokenized, traded globally, and owned fractionally.

The convergence of traditional finance and blockchain technology is creating unprecedented opportunities. Those who understand and adapt to these changes will be well-positioned for the future of finance.

The question isn't whether tokenization will become mainstream, but how quickly. All signs point to acceleration.

Learn More: Blockchain Security & Token Technology#

Comprehensive Technology Guide:

→ Blockchain Security & Token Technology: 2025 Reference Guide - Complete technical reference

Related Technology Articles:

- ERC-3643 vs ERC-1400: Security Token Standards Explained - Standards comparison

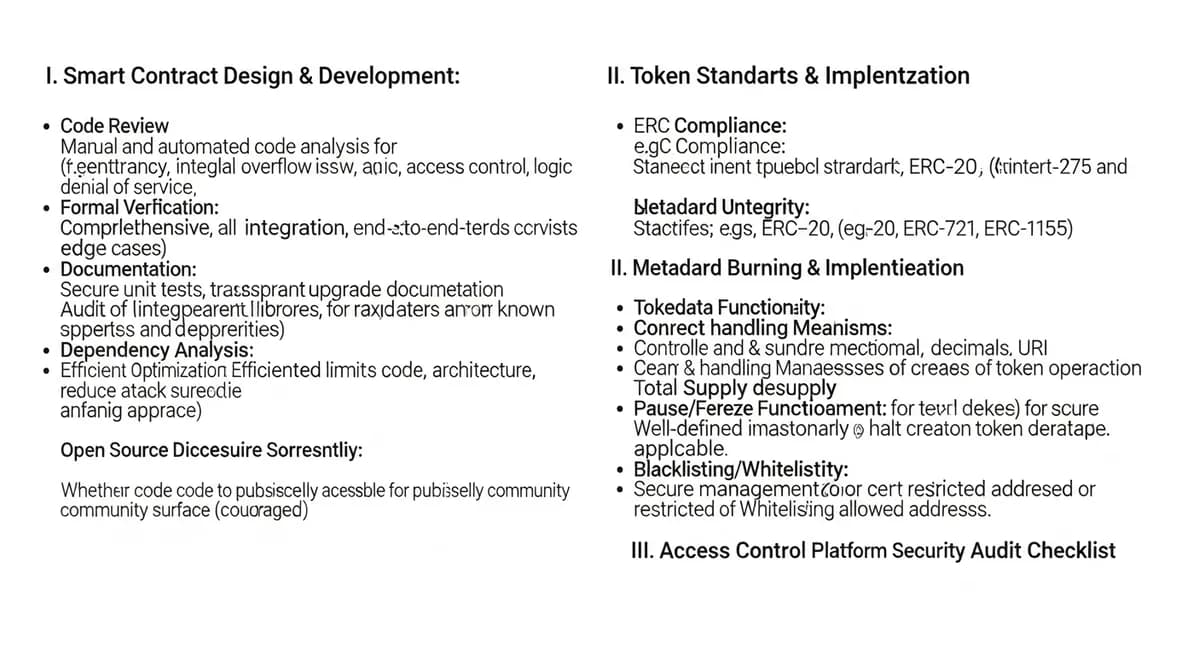

- Smart Contract Security Audit Checklist for Tokenization - Security audit framework

- Cross-Border Tokenized Settlement: Revolutionizing International Asset Transfers - Settlement technology

- Blockchain Security: Best Practices for Asset Tokenization - Security best practices

Investment & Platform:

- How to Invest in Tokenized Assets: Complete 2025 Guide - Investment guide

- Best Tokenization Platforms 2025: Enterprise Comparison Guide - Platform comparison

Next Steps:

- Subscribe to Our Newsletter - Stay ahead of the curve

- Contact Our Team - Get future insights

Stay ahead of the curve. Subscribe to our newsletter for the latest insights.