Beginner's Guide to Investing in Tokenized Assets

Beginner-focused guide: This article provides an introduction to investing. For comprehensive investment guidance covering all aspects, see How to Invest in Tokenized Assets: Complete 2025 Guide.

New to tokenized assets? This guide will walk you through everything you need to know to get started safely and confidently.

For comprehensive understanding, explore our Ultimate Guide to Tokenization and RWA. Learn fund strategies in our Tokenized Investment Funds guide, and explore investment approaches in our RWA in Banking guide.

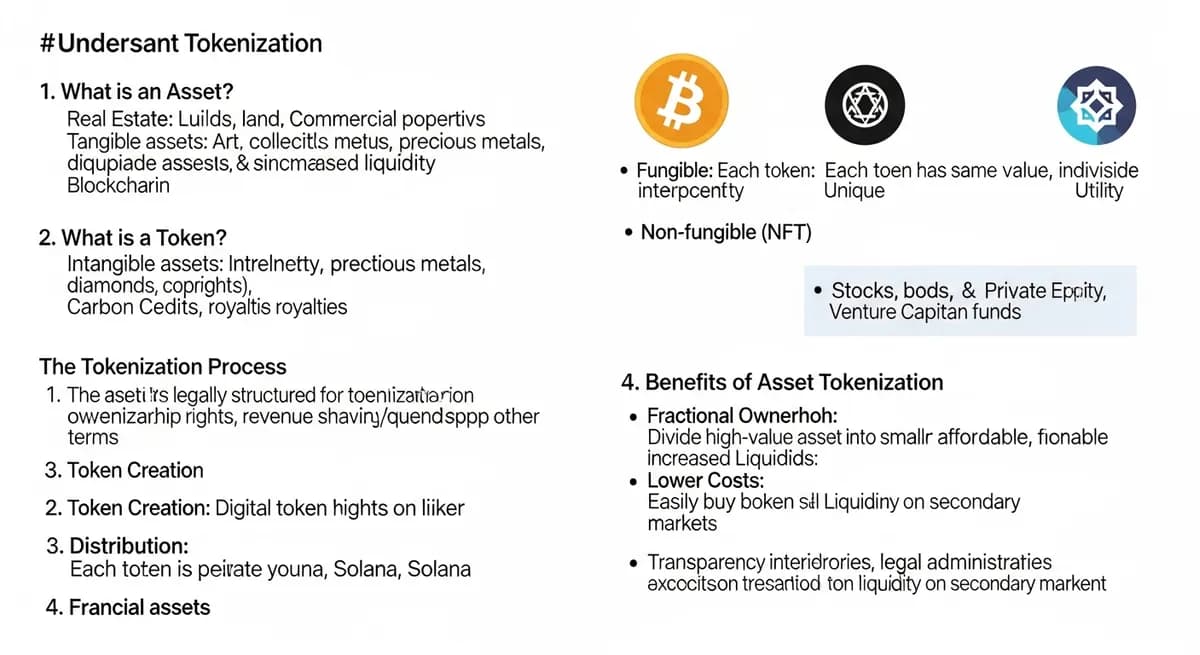

What Are Tokenized Assets?#

Tokenized assets are digital representations of real-world assets on a blockchain. These can include:

- Real Estate: Commercial properties, residential buildings

- Private Equity: Startup shares, venture capital

- Fine Art: Paintings, collectibles, luxury items

- Commodities: Gold, silver, agricultural products

- Bonds: Corporate bonds, government securities

Why Invest in Tokenized Assets?#

1. Lower Entry Barriers#

Traditional investments often require large minimum amounts ($50,000+). Tokenization allows fractional ownership starting from as little as $100.

2. Diversification#

Access various asset classes that were previously unavailable to retail investors.

3. Liquidity#

Trade tokens more easily than traditional illiquid assets like real estate or private equity.

4. Transparency#

Blockchain technology provides immutable records of ownership and transactions.

5. Global Access#

Invest in assets worldwide without geographic restrictions.

Getting Started: Step-by-Step#

Step 1: Education#

Before investing:

- Learn about blockchain basics

- Understand tokenization

- Research different asset types

- Know the risks involved

Step 2: Choose a Platform#

Select a reputable tokenization platform:

- Check regulatory compliance

- Read user reviews

- Verify security measures

- Compare fees

Step 3: Complete KYC#

All regulated platforms require identity verification:

- Provide government ID

- Proof of address

- Sometimes source of funds

- This protects both you and the platform

Step 4: Fund Your Account#

Most platforms accept:

- Bank transfers

- Credit/debit cards

- Cryptocurrency

- Wire transfers

Step 5: Research Investments#

Before investing, explore different asset classes:

- Real Estate Tokenization - Property investment fundamentals

- Startup Equity - Private company investments

- REITs vs Tokenized Real Estate - Investment comparison

- Asset Selection Framework - How to evaluate opportunities

- ROI Calculator - Calculate potential returns

Step 6: Start Small and Diversify#

Before investing in any token:

- Read the offering documents

- Understand the underlying asset

- Check the business model

- Review financial projections

- Assess risks carefully

Step 6: Start Small#

Begin with smaller amounts:

- Test the platform

- Learn the process

- Build confidence

- Understand how it works

Step 7: Diversify#

Don't put all eggs in one basket:

- Spread across asset types

- Different risk levels

- Various geographic regions

- Multiple issuers

Step 8: Monitor & Manage#

Track your investments:

- Regular portfolio reviews

- Stay informed on updates

- Rebalance as needed

- Take profits when appropriate

Common Mistakes to Avoid#

1. Insufficient Research#

Never invest without thorough due diligence.

2. Ignoring Risks#

All investments carry risk. Read risk warnings carefully.

3. Over-concentration#

Diversification is key to managing risk.

4. Emotional Decisions#

Stick to your investment strategy, don't panic sell.

5. Ignoring Fees#

Understand all costs involved before investing.

6. Not Understanding Technology#

Learn basics of how blockchain and smart contracts work.

Investment Strategies#

Conservative Approach#

- Focus on established assets (real estate, bonds)

- Lower risk, lower potential returns

- Suitable for risk-averse investors

- Emphasis on capital preservation

Balanced Approach#

- Mix of established and growth assets

- Moderate risk, moderate returns

- Diversified portfolio

- Long-term focus

Aggressive Approach#

- Higher allocation to startups and emerging assets

- Higher risk, higher potential returns

- Suitable for risk-tolerant investors

- Active management required

Risk Management#

Diversification Rules#

- No more than 5-10% in any single asset

- Spread across different asset types

- Consider geographic diversification

- Mix different risk levels

Position Sizing#

- Start with 1-2% of portfolio per investment

- Increase position as you gain experience

- Never invest more than you can afford to lose

Regular Reviews#

- Monthly portfolio check

- Quarterly rebalancing

- Annual strategy review

- Stay informed on market changes

Tax Considerations#

Tokenized assets may have tax implications:

- Capital gains on profits

- Dividend/distribution taxes

- Different rules by jurisdiction

- Consult tax professionals

Red Flags to Watch For#

Avoid investments that:

- Promise guaranteed returns

- Lack proper documentation

- Have unclear business models

- Missing regulatory compliance

- Pressure you to invest quickly

- Seem too good to be true

Next Steps#

Ready to start investing?

- Sign up on a reputable platform

- Complete KYC verification

- Start with $100-500 to learn

- Research thoroughly before each investment

- Diversify across multiple assets

- Monitor regularly and stay informed

Key Takeaways#

- Start small and learn

- Diversification is crucial

- Understand the risks

- Do your research

- Use reputable platforms

- Think long-term

- Never invest more than you can afford to lose

Learn More: Investing in Tokenized Assets#

Comprehensive Investment Guide:

→ How to Invest in Tokenized Assets: Complete 2025 Guide - Master the complete investment framework

Related Investment Articles:

- What is Asset Tokenization? The Ultimate 2025 Beginner's Guide - Comprehensive beginner guide

- How to Start Investing in Tokenized Assets: 2025 Step-by-Step Guide - Getting started

- How to Invest in Tokenized Assets: Complete Step-by-Step Guide - Detailed steps

- Introduction to Asset Tokenization - Basic concepts

- Tokenized Asset Investment Returns: Real Data from 2024 - Understand returns

Platform & Security:

- Best Tokenization Platforms 2025: Enterprise Comparison Guide - Choose the right platform

- Tokenization Platform Security: What Investors Need to Know - Security guide

Resources:

- Investment Guide - Detailed investment information

- Risk Warning - Important risk disclosures

- Support - Get help from our team

Next Steps:

- Create Your Account - Start your tokenization journey

- Contact Our Team - Get personalized guidance

Disclaimer: This is educational content, not investment advice. Consult financial advisors before making investment decisions.