ERC-3643 vs ERC-1400: Security Token Standards Explained

Technical deep-dive: This article compares token standards. For comprehensive blockchain security and technology guidance, see Blockchain Security & Token Technology: 2025 Reference Guide.

Two standards dominate security token implementation: ERC-3643 and ERC-1400. Understanding their differences is essential when choosing a tokenization approach.

For comprehensive context, see our Ultimate Guide to Tokenization and RWA. Learn about legal structures in our Tokenization Legal Structure guide, and compare approaches in our RWA vs Traditional Securities guide.

Quick Comparison#

| Feature | ERC-3643 | ERC-1400 |

|---|---|---|

| Status | ISO 20022 standard (2023) | De facto standard (2018) |

| Compliance | Modular (composable) | Built-in restrictions |

| Adoption | Growing (enterprise) | Established (startups) |

| Complexity | Higher | Moderate |

| Flexibility | Very high | Medium |

| Gas Efficiency | Lower (modular) | Higher (simpler) |

| Industry | Financial institutions | Crypto platforms |

ERC-3643: The Enterprise Standard#

Architecture#

Core Concept: Modular compliance framework

- Identity registry (who holds tokens)

- Claim issuers (verify identity attributes)

- Compliance contracts (enforce rules)

- Allowed whitelist (permit transfers)

How It Works#

Transfer Request

↓

Check identity in Registry

↓

Verify claims with Issuer

↓

Run compliance contracts

↓

Check allowed whitelist

↓

Execute transfer or reject

Strengths#

✅ ISO Standard: Internationally recognized ✅ Modular: Add/remove compliance rules easily ✅ Enterprise Ready: Used by major financial institutions ✅ Scalable: Handles complex compliance ✅ Future Proof: Can evolve without redeployment

Weaknesses#

❌ Complex: Steeper learning curve ❌ Higher Gas: More checks = higher costs ❌ Overhead: Requires identity registry management ❌ Slower: Multiple compliance checks take time

Best For#

- Large enterprises

- Complex compliance requirements

- Regulated institutions

- Global offerings

- Mission-critical applications

Implementation Example#

interface IToken {

function transfer(address to, uint256 value) external returns (bool);

function approve(address spender, uint256 value) external returns (bool);

}

interface IIdentityRegistry {

function isRegistered(address user) external view returns (bool);

}

interface IComplianceModule {

function canTransfer(address from, address to, uint256 amount)

external view returns (bool);

}

ERC-1400: The Flexible Standard#

Architecture#

Core Concept: Simple token with operator control

- Operator control (third-party transfer authority)

- Partition management (segregate token classes)

- Controller burn (force redemption)

- Document management (store legal docs)

How It Works#

Transfer Request

↓

Check if sender is operator

↓

Verify partition exists

↓

Execute transfer

↓

Emit events

Strengths#

✅ Simpler: Easier to understand and implement ✅ Lower Gas: Fewer checks ✅ Flexible: Operator model works for many use cases ✅ Partition Model: Elegant way to handle classes ✅ Document Links: Stores legal framework references

Weaknesses#

❌ Less Mature: Fewer production deployments ❌ Operator Risk: Centralized control possible ❌ Limited Compliance: Built-in limitations basic ❌ Partition Complexity: Managing classes complex

Best For#

- Startups

- Simple compliance requirements

- Single-jurisdiction offerings

- Performance-critical applications

- Innovation and experimentation

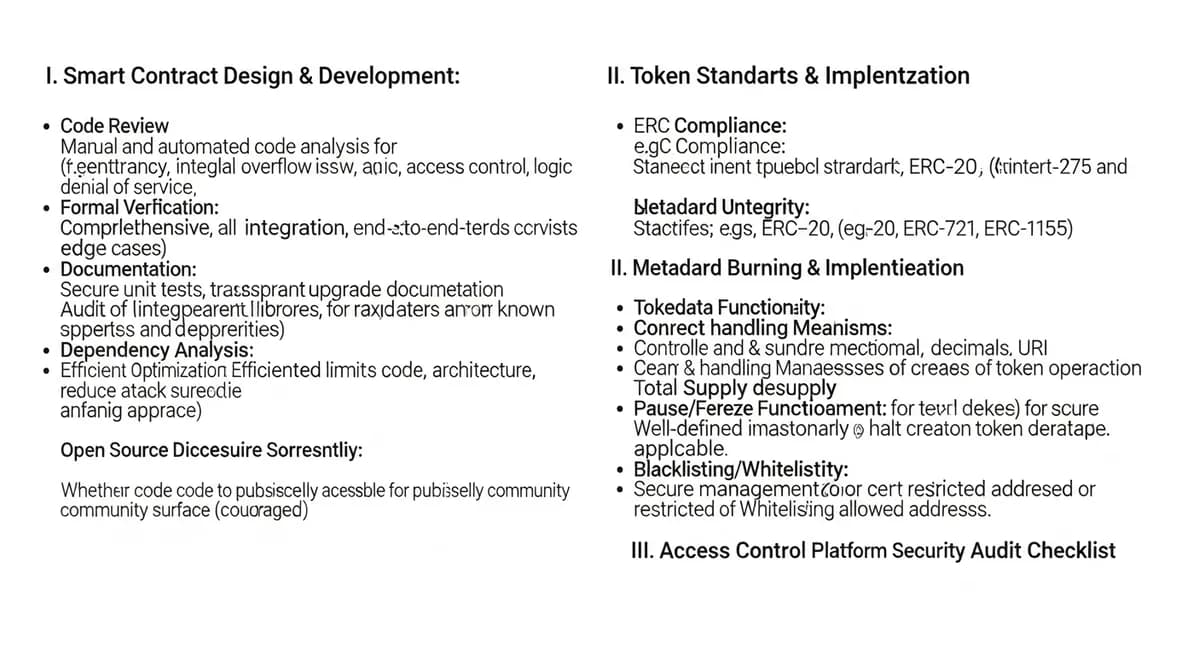

Security Considerations: Before deploying any standard, review our Smart Contract Security Audit Checklist for Tokenization to ensure secure implementation.

Implementation Example#

interface IERC1400 {

function transferWithData(address to, uint256 value, bytes data) external;

function setPartitionControllers(bytes32 partition, address[] controllers) external;

function redeemByPartition(bytes32 partition, uint256 value, bytes data) external;

}

Real-World Use Case Comparison#

Scenario: Tokenizing Manhattan Office Building#

Using ERC-3643:

- Create identity registry

- Define compliance rules (accredited investor check, transfer limits)

- Deploy compliance contracts

- Register all investors

- Transfer checks run against all rules

Cost: $100-150K setup, $0.50-2 per transfer

Using ERC-1400:

- Deploy token contract

- Define partitions (US investors, international, etc.)

- Set operator permissions

- Transfer occurs with partition check

Cost: $50-80K setup, $0.20-0.50 per transfer

Scenario: Small Cap Bond Tokenization#

Better Approach: ERC-1400

- Simpler to manage

- Lower costs

- Sufficient compliance (basic restrictions)

Better Approach: ERC-3643

- If multi-jurisdictional

- If complex investor rules needed

- If integration with identity systems required

Interoperability#

Can ERC-3643 tokens interact with ERC-1400?#

Short answer: Not directly.

Technical reason: Different standards, different interfaces

Solution: Bridges/wrappers (complex, expensive)

Recommendation: Choose standard upfront; don't switch mid-stream

Migration Paths#

From ERC-1400 to ERC-3643#

Not recommended once deployed (requires:)

- New contract deployment

- Token redemption/swap

- Investor coordination

- Regulatory re-approval

Cost: $200-500K

Better Approach#

Choose correctly at launch:

- Startup → ERC-1400

- Institutional → ERC-3643

- Hybrid → Consider emerging standards

Industry Adoption#

ERC-3643 Leaders#

- BNY Mellon (working with standard)

- Euroclear (blockchain integration)

- SGX (Singapore exchange)

- Major EU regulated entities

ERC-1400 Leaders#

- Polymath (platform)

- tZero (tokens)

- Ethereum-based issuances

- Blockchain startups

Cost Comparison (Full Lifecycle)#

ERC-1400 Project#

Development: $50-80K

Audit: $30-60K

Deployment: $5-10K

Operations/year: $20-50K

Total Year 1: $105-200K

ERC-3643 Project#

Development: $100-150K

Audit: $60-100K

Deployment: $10-20K

Operations/year: $50-100K

Total Year 1: $220-370K

Performance Metrics#

| Metric | ERC-3643 | ERC-1400 |

|---|---|---|

| Gas per Transfer | 150K-200K | 80K-120K |

| Query Time | 500ms-2s | 50-200ms |

| Throughput | 100 tx/s | 500+ tx/s |

| Scale Limit | 100K identities | N/A |

Decision Matrix#

Choose ERC-3643 if:

- Large enterprise

- Multi-jurisdictional

- Complex compliance needs

- Budget $300K+

- Want future flexibility

Choose ERC-1400 if:

- Startup or SME

- Single jurisdiction

- Basic compliance

- Budget $150K

- Want simplicity

Choose Emerging Standard if:

- Extreme scale needed

- Novel use case

- Time to market critical

Platform Support: See which platforms support each standard in our Best Tokenization Platforms 2025 Buyer's Guide and Tokenization Platform Comparison 2025. For enterprise needs, see Institutional Tokenization: Enterprise Platform Requirements.

Emerging Alternatives (2025+)#

Account Abstraction (ERC-4337)#

- Account-based token transfers

- Better UX (no seed phrases)

- Still evolving

Layer 2 Standards#

- Optimism, Arbitrum specific

- Lower costs

- Faster transfers

For detailed L2 analysis, see Layer 1 vs Layer 2 for Security Tokens: Speed, Cost & Compliance Compared.

Blockchain Architecture Choice#

Beyond token standards, the choice between public and private blockchains affects compliance, costs, and scalability.

See Public vs Private Blockchain for Asset Tokenization: 2025 Enterprise Guide for decision framework.

Stablecoin Standards#

- For wrapped assets

- Mass adoption focus

Conclusion#

ERC-3643 = Enterprise, complexity, compliance, scale ERC-1400 = Startup, simplicity, performance, flexibility

Choose based on your needs, budget, and timeline. Once launched, switching standards is extremely difficult.

Learn More: Blockchain Security & Token Technology#

Comprehensive Technology Guide:

→ Blockchain Security & Token Technology: 2025 Reference Guide - Complete technical reference

Related Technology Articles:

- Public vs Private Blockchain for Asset Tokenization - Architecture comparison

- Layer 1 vs Layer 2 for Security Tokens - Scaling comparison

- Smart Contract Security Audit Checklist for Tokenization - Security audit framework

- Tokenization Platform Security: What Investors Need to Know - Platform security

- Blockchain Security: Best Practices for Asset Tokenization - Security best practices

- Cross-Border Tokenized Settlement: Revolutionizing International Asset Transfers - Settlement technology

Enterprise & Platform:

- Best Tokenization Platforms 2025: Enterprise Comparison Guide - Platform technical comparison

- Tokenization API Integration: Developer Documentation Guide - API integration

Regulatory:

- Tokenization Licensing Requirements by Jurisdiction 2025 - Regulatory requirements

Next Steps:

- Contact Our Technical Team for implementation guidance

- Schedule a Technical Consultation - Get expert advice

Disclaimer: Technical comparison educational only. Consult technical and legal advisors for specific implementation decisions.