Tokenizing Real-World Cashflow: The End of Traditional Banking Dominance

Banking disruption analysis: This article explores cashflow tokenization. For comprehensive geopolitical and strategic analysis, see Tokenization as a Geopolitical Weapon: The New Financial Empire Architecture.

The banking system is built on a lie. The lie is that banks control money. They don't. They control cashflow—the movement of money through time and space. And tokenization is about to break that control forever.

This is not a prediction. This is an observation. The infrastructure exists. The capital is flowing. The shift is happening. Banks are fighting a rearguard action, but they're fighting against the tide of history.

The question is not whether banking will be disrupted. The question is how fast, and who will control the new system.

For comprehensive context, see our Ultimate Guide to Tokenization and RWA. Learn finance applications in our RWA in Banking guide, and compare approaches in our RWA vs Traditional Securities guide.

Why Cashflow Is the Real Asset#

Money is not the asset. Cashflow is the asset.

A $100 bill sitting in a vault is worthless. The same $100 flowing through an economy creates value. Banks understand this. That's why they don't just hold money—they control its flow.

The Banking Model: Banks take deposits (money at rest) and turn them into loans (money in motion). They profit from the spread between deposit rates and lending rates. But more importantly, they control who gets access to cashflow, when they get it, and under what conditions.

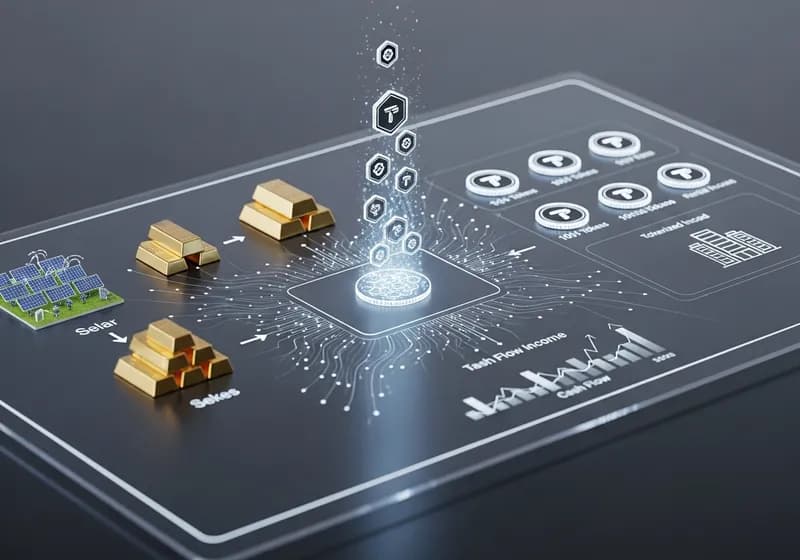

The Tokenization Model: Tokenization enables direct cashflow control. Instead of going through banks, cashflow can be tokenized, traded, and allocated through blockchain infrastructure. This eliminates the banking intermediary entirely.

The Power Shift: When cashflow is tokenized, banks lose their monopoly. They become optional, not essential. And when banks are optional, their power disappears.

This is the fundamental disruption. Not faster payments. Not lower fees. Not better technology. The disruption is the elimination of banking's monopoly on cashflow control.

How Banks Control Cashflow Today#

To understand how tokenization breaks banking, we must first understand how banks maintain their control:

The Credit Creation Monopoly#

Banks don't just lend existing money. They create new money through fractional reserve banking. When a bank makes a loan, it creates new deposits, expanding the money supply. This is a form of power that no other institution has.

The Mechanism:

- Bank receives $100 deposit

- Bank lends $90 (keeping $10 reserve)

- Borrower spends $90, which becomes a deposit at another bank

- That bank lends $81, creating more deposits

- Process repeats, creating money multiplier effect

The Power: Banks control who gets credit, how much, and at what price. This is economic power on a massive scale.

The Vulnerability: Tokenization enables direct credit creation without banks. Smart contracts can create tokenized credit backed by real-world cashflow, eliminating the banking intermediary.

The Payment Infrastructure Monopoly#

Banks control the payment rails. Every transaction flows through banking infrastructure—ACH, wire transfers, credit cards, SWIFT. This gives banks visibility and control over economic activity.

The Mechanism:

- All payments flow through bank accounts

- Banks see every transaction

- Banks can freeze, restrict, or redirect payments

- Banks collect fees on every transaction

The Power: Banks are the gatekeepers of economic activity. They can exclude actors, restrict flows, and extract value from every transaction.

The Vulnerability: Blockchain enables direct peer-to-peer payments without banking infrastructure. Tokenized cashflow can flow directly between parties, bypassing banks entirely.

The Information Monopoly#

Banks have exclusive access to financial data. They see who has money, who needs money, who is creditworthy, and who is risky. This information asymmetry is a source of power.

The Mechanism:

- Banks see all account activity

- Banks have credit histories

- Banks know cashflow patterns

- Banks use this data to make lending decisions

The Power: Information is power. Banks use their data advantage to extract value, make better decisions, and maintain competitive advantages.

The Vulnerability: On-chain cashflow data is public (or selectively private). Tokenization creates transparent cashflow records that anyone can analyze, eliminating banking's information monopoly.

The Regulatory Capture#

Banks have captured the regulatory system. Regulations are written by banks, enforced by banks, and designed to protect banks. This creates barriers to entry that prevent competition.

The Mechanism:

- Banking licenses are expensive and difficult to obtain

- Regulations favor existing banks

- Regulators are often former bankers

- Banking lobbyists write legislation

The Power: Regulatory capture prevents competition, maintains monopolies, and protects banking profits.

The Vulnerability: Tokenization operates in regulatory gray areas. Smart contracts don't need banking licenses. Tokenized cashflow can operate outside traditional banking regulations, at least initially.

On-Chain Cashflow Models#

Tokenization enables new models of cashflow control that bypass banks entirely:

Revenue Tokenization#

Companies can tokenize their future revenue streams, creating digital assets that represent claims on cashflow.

The Model:

- Company tokenizes $10M in future revenue

- Tokens represent fractional ownership of revenue stream

- Investors buy tokens, providing upfront capital

- Company receives capital without going through banks

- Revenue flows directly to token holders

The Power Shift: Companies gain direct access to capital markets without banking intermediaries. Investors gain direct exposure to cashflow without banking fees.

The Disruption: Banks lose their role as credit intermediaries. They become irrelevant to the cashflow economy.

Invoice Tokenization#

Companies can tokenize their invoices, creating tradeable assets that represent claims on future payments.

The Model:

- Company has $1M in outstanding invoices

- Company tokenizes invoices, creating digital assets

- Investors buy tokens, providing immediate liquidity

- When invoices are paid, funds flow to token holders

- Company receives cashflow acceleration without bank financing

The Power Shift: Companies can monetize receivables directly, without factoring companies or bank loans. Investors gain access to short-term cashflow assets.

The Disruption: Banks lose their role in working capital financing. Invoice tokenization eliminates the need for bank credit lines.

Subscription Tokenization#

SaaS companies and subscription businesses can tokenize their recurring revenue, creating assets that represent claims on future subscription payments.

The Model:

- SaaS company has $5M in annual recurring revenue

- Company tokenizes future subscription payments

- Tokens represent fractional ownership of subscription cashflow

- Investors buy tokens, providing growth capital

- Subscription payments flow directly to token holders

The Power Shift: Subscription businesses can raise capital directly from investors, without venture capital or bank loans. Investors gain exposure to predictable cashflow.

The Disruption: Banks lose their role in business lending. Subscription tokenization enables direct capital access for recurring revenue businesses.

Royalty Tokenization#

Content creators, musicians, and IP owners can tokenize their royalty streams, creating assets that represent claims on future royalty payments.

The Model:

- Musician has $500K in annual music royalties

- Musician tokenizes future royalty payments

- Tokens represent fractional ownership of royalty cashflow

- Fans and investors buy tokens, providing upfront capital

- Royalty payments flow directly to token holders

The Power Shift: Creators can monetize future cashflow directly, without record labels or publishers. Fans can invest in creators they believe in.

The Disruption: Traditional content intermediaries become irrelevant. Royalty tokenization enables direct creator-investor relationships.

Tokenized Revenue for Specific Industries#

Let's examine how tokenized cashflow will disrupt specific industries:

Factories: Manufacturing Cashflow#

Manufacturing companies have predictable cashflow from production and sales. Tokenization enables direct monetization of this cashflow.

The Opportunity:

- Factory produces goods with predictable revenue

- Factory tokenizes future production revenue

- Investors buy tokens, providing working capital

- Revenue from sales flows directly to token holders

- Factory receives capital without bank loans

The Disruption: Manufacturing companies can raise capital directly from investors, bypassing banks entirely. Banks lose their role in industrial financing.

The Scale: Global manufacturing is a $15 trillion industry. Even a small percentage of tokenization represents massive disruption to banking.

SaaS: Subscription Cashflow#

Software-as-a-Service companies have recurring revenue that is perfect for tokenization.

The Opportunity:

- SaaS company has predictable monthly recurring revenue

- Company tokenizes future subscription payments

- Investors buy tokens, providing growth capital

- Subscription payments flow directly to token holders

- Company receives capital without venture capital or bank loans

The Disruption: SaaS companies can raise capital directly from investors, reducing dependence on VCs and banks. The entire venture capital model becomes optional.

The Scale: Global SaaS market is $200+ billion and growing. Tokenization could capture a significant portion of this market.

Distribution Companies: Trade Cashflow#

Distribution companies have cashflow from buying and selling goods. Tokenization enables direct monetization of trade flows.

The Opportunity:

- Distribution company has predictable trade cashflow

- Company tokenizes future trade revenue

- Investors buy tokens, providing inventory financing

- Revenue from sales flows directly to token holders

- Company receives capital without trade finance banks

The Disruption: Distribution companies can finance inventory directly from investors, bypassing trade finance banks. Banks lose their role in supply chain financing.

The Scale: Global trade finance is a $10+ trillion market. Tokenization could capture a significant portion.

New Lending Without Banks#

Tokenized cashflow enables new forms of lending that don't require banks:

Peer-to-Peer Lending#

Investors can lend directly to borrowers, with tokenized cashflow as collateral.

The Model:

- Borrower tokenizes future cashflow

- Lender buys tokens, providing loan capital

- Cashflow payments serve as loan repayment

- Smart contracts automate the process

- No bank intermediary required

The Power Shift: Lending becomes decentralized. Banks lose their role as credit intermediaries.

The Scale: Global lending market is $100+ trillion. Even a small percentage of tokenization represents massive disruption.

Automated Lending Protocols#

Smart contracts can automate lending based on tokenized cashflow, creating decentralized credit markets.

The Model:

- Borrowers tokenize cashflow

- Lending protocol evaluates creditworthiness

- Smart contracts match lenders and borrowers

- Automated repayment from cashflow

- No human intermediaries required

The Power Shift: Lending becomes automated and decentralized. Banks become irrelevant.

The Innovation: AI can analyze on-chain cashflow data to make better lending decisions than banks, creating competitive advantages.

Collateralized Lending#

Tokenized cashflow can serve as collateral for other loans, creating new forms of leverage.

The Model:

- Borrower tokenizes $1M in future cashflow

- Borrower uses tokens as collateral for $500K loan

- Lender holds tokens as security

- If borrower defaults, lender receives cashflow tokens

- No bank required for collateralization

The Power Shift: Collateral becomes programmable and tradeable. Banks lose their role in secured lending.

The Innovation: Tokenized collateral can be automatically liquidated, reducing risk and enabling new lending models.

Who Loses Power?#

The shift to tokenized cashflow will eliminate many traditional power structures:

Banks: The Obvious Losers#

Banks lose their monopoly on cashflow control. They become optional, not essential. When banks are optional, their power disappears.

What They Lose:

- Credit creation monopoly

- Payment infrastructure control

- Information asymmetry advantages

- Regulatory protection

How They Respond:

- Some banks will adapt, becoming tokenization infrastructure providers

- Most banks will resist, fighting rearguard actions through regulation

- All banks will lose power, regardless of their response

Central Banks: The Hidden Losers#

Central banks control monetary policy through banking systems. When banks become irrelevant, central banks lose their primary mechanism of control.

What They Lose:

- Monetary policy transmission mechanisms

- Control over money supply

- Ability to influence economic activity

How They Respond:

- Central banks will explore CBDCs as alternatives

- But CBDCs might accelerate the shift away from traditional banking

- Central banks face an existential crisis

Credit Rating Agencies: The Forgotten Losers#

Credit rating agencies provide information about creditworthiness. Tokenized cashflow creates transparent, on-chain data that makes credit ratings less valuable.

What They Lose:

- Information monopoly

- Pricing power

- Relevance

How They Respond:

- Some agencies will adapt, analyzing on-chain data

- Most will become irrelevant

- The entire credit rating industry faces disruption

Factoring Companies: The Niche Losers#

Factoring companies provide working capital financing by purchasing invoices. Invoice tokenization eliminates their business model.

What They Lose:

- Entire business model

- Market relevance

- Competitive advantages

How They Respond:

- Some will adapt, becoming tokenization platforms

- Most will disappear

- The factoring industry faces extinction

Future of Cashflow Economies#

The shift to tokenized cashflow will create new economic structures:

Direct Capital Markets#

Companies will raise capital directly from investors, without banking intermediaries. This creates more efficient capital allocation and reduces costs.

The Vision: A world where any company with predictable cashflow can tokenize it and raise capital directly from global investors, without banks, VCs, or other intermediaries.

The Impact: Capital becomes more accessible, more efficient, and more democratic. But power shifts to those who control the tokenization infrastructure.

Programmable Cashflow#

Smart contracts enable programmable cashflow—cashflow that automatically allocates, distributes, and reinvests based on predefined rules.

The Vision: Cashflow that automatically pays investors, reinvests profits, and optimizes allocation based on AI-driven algorithms.

The Impact: Cashflow becomes more efficient and automated. But it also becomes more controlled by those who write the code.

Global Cashflow Markets#

Tokenization enables global cashflow markets where investors can buy and sell cashflow assets from anywhere in the world.

The Vision: A global marketplace where investors can buy tokenized cashflow from factories in China, SaaS companies in the US, and distribution companies in Europe, all on a single platform.

The Impact: Capital flows become more global and efficient. But they also become more concentrated in the hands of infrastructure controllers.

Cashflow as Currency#

Tokenized cashflow might become a form of currency—a medium of exchange backed by real-world cashflow rather than government fiat.

The Vision: A world where tokenized cashflow serves as money, creating currencies backed by productive assets rather than government promises.

The Impact: Monetary power shifts from governments to those who control cashflow tokenization. This is a fundamental shift in the balance of power.

Conclusion: The Banking System Is Obsolete#

The banking system is built on controlling cashflow. Tokenization breaks that control. When cashflow can flow directly between parties, banks become irrelevant.

This is not a gradual transition. This is a phase transition. At a certain threshold of tokenization, the banking system collapses. Not physically—banks will still exist. But their power will disappear.

The question is not whether this will happen. The question is how fast, and who will control the new system.

For Companies: Tokenize your cashflow now, before competitors do. Gain direct access to capital markets. Reduce dependence on banks. Build competitive advantages.

For Investors: Understand that tokenized cashflow is the future. Invest in cashflow assets, not just equity. Gain exposure to the cashflow economy. Position yourself for the shift.

For Banks: Adapt or die. Become tokenization infrastructure providers, or become irrelevant. The choice is yours, but the window is closing.

For Everyone: Recognize that the banking system is obsolete. Cashflow is being tokenized. Banks are losing control. The future belongs to those who understand and adapt.

The age of banking dominance is ending. The age of tokenized cashflow is beginning.

Choose your side. But choose quickly. The shift is happening fast, and those who wait will be left behind.

Continue Reading#

Explore more about cashflow tokenization and DeFi:

- DeFi vs Traditional Finance - The broader battle for finance

- Private Credit Tokenization - Tokenizing lending

- Invoice Financing Tokenization - SME cashflow solutions

- Supply Chain Finance Tokenization - Trade finance innovation

- RWA DeFi Protocols Guide 2025 - Leading DeFi protocols

- How to Invest in Tokenized Assets - Start investing

The Strategic Research Division publishes analysis on the future of financial power, geopolitical dynamics, and the architecture of global capital systems. This is not investment advice. This is power analysis.